(If throwing a contribution Pottersville2's way won't break your budget in these difficult financial times, I really need it, and would wholeheartedly appreciate it. Anything you can afford will make a huge difference in this blog's lifetime.)

William Boardman, Reader Supported News

"There were no official war bulletins about Syria from the White House last week, but the news is just as official as if there were: the United States is now in war in Syria."

Read more here.Why Does No One Speak of America’s Oligarchs?

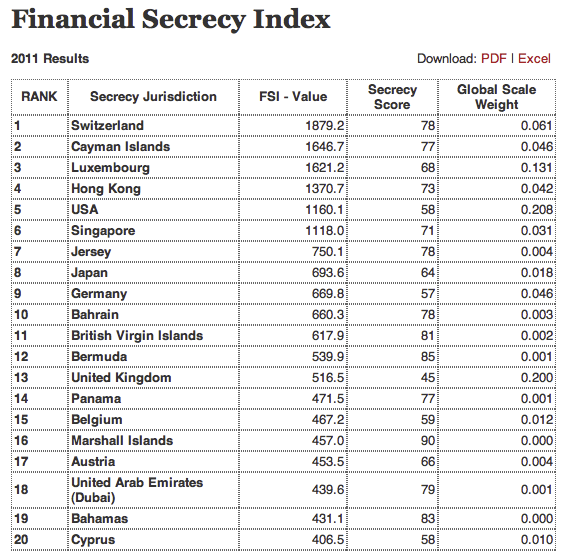

One of the striking elements of the demonization of Cyprus was how it was depicted as a willing tool of Russian money launderers and oligarchs. Never mind the fact, as we pointed out, that Cyprus is not a tax haven but a low-tax jurisdiction, and in stark contrast with the Caymans and Malta, has double-taxation treaties signed with 46 nations and has (now more likely had) with six more being ratified. Nor is it much of a tax secrecy jurisdiction, according to the Financial Secrecy Index. Confusingly, in the overall ranking, lower numbers are worse (Switzerland as number 1 is the baaadest) but in the secrecy score used to derive the rankings, higher is worse, with 100 being utterly opaque. The total rank is a function of “badness” (secrecy score) and weight (amount of business done).

You’ll notice that all the countries ranked as worse than Cyprus have secrecy scores more unfavorable than it, with the exception of Germany, which is a mere 1 point out of 100 less bad, and the UK, which scores considerably lower (Nicholas Shaxson, author of Treasure Islands, would take issue with that reading, but he takes a more inclusive view of the boundaries of a financial services industry. For the UK, thus he not only includes the “state within a state” of the City of London, but also the UK’s secrecy jurisdictions, such as the Isle of Man, in his dim view of the UK as well as the US on secrecy). And even so, its greater volume of hidden activity gives it a much worse overall ranking. Of countries 21 tp 30, only 3 rank as less bad on secrecy: Canada, India, and South Korea.

And as far as how many oligarchs have deposits there, even the New York Times, in a story framed around a lawyer who sets up shell companies for Russian investors, mentions in passing at the end

Any dirty money flowing through Cyprus, however, is dwarfed by funds generated by legitimate businesses looking for easy and legal ways to avoid taxes. There are so many Russian companies registered in Cyprus for tax reasons that the tiny country now ranks as Russia’s biggest source of direct foreign investment, most of it from Russian nationals through vehicles registered in Cyprus.And the oligarchs with meaningful involvement in Cyprus? The New York Times did find one, but he seems to be the exception rather than the rule. From Cyprus Mail:

“You must be out of your mind!” snapped tycoon Igor Zyuzin, main owner of New York-listed coal-to-steel group Mechel , as he dismissed a suggestion this week that the financial meltdown in Cyprus posed a risk to his interests.Now notice how much space I’ve devoted to showing that major parts of the conventional narrative about Cyprus are not all that they are cracked up to be. But see another implicit part of the story: that Russia’s oligarchs and “dirty money” are a distinctive national creation. Do you ever hear Carlos Slim or Rupert Murdoch or the Koch Brothers described as oligarchs? To dial the clock back a bit, how about Harold Geneen of ITT, which was widely known to conduct assassinations in Latin America if it couldn’t get its way by less thuggish means? (This is not mere rumor, I’ve had it confirmed by a former ITT executive).

His response is typical across the oligarch class of major corporations and super-rich individuals, reflecting the assessment of officials and bankers on the Mediterranean island who say the bulk of the billions of euros of Russian money in Cyprus comes from smaller firms and middle-class savers…

Sources in the wealth management, advisory and banking industry in Nicosia say Russia depositors are typically smaller savers and entrepreneurs. Fiona Mullen, a British economist in Cyprus, said Russians she encounters tend to be buying 300,000-euro homes, not the palaces favoured by oligarchs in London.

The one way in which the Russians top rich do occupy a distinctive place is in the role that violence often played in their ascent. But violence is also a common feature in what reader Scott called the Land of the Dash Cam. Nevertheless, one of my colleagues who opened the Moscow office for Dun & Bradstreet and got it profitable in a year and a half bragged that she was probably the only person who sued a Russian oil company, won the case, collected the judgment, and lived to tell the tale, She also had an ex KGB officer as driver who filled her in on the finer points of murder, Russian style (for instance, to really cover your tracks, you need three people: A kills the person you want dead, B kills A, and C kills B. Type A is pretty cheap to hire, but finding the person for the B role is the expensive item, since he has to be skilled enough to kill a low level killer. Of course, C is not cheap either).

Nevertheless, Simon Johnson clearly described in his important 2009 Atlantic article, The Quiet Coup, that American was in the hands of oligarchs:

Every crisis is different, of course….But I must tell you, to IMF officials, all of these crises looked depressingly similar . . . .Typically, these countries are in a desperate economic situation for one simple reason—the powerful elites within them overreached in good times and took too many risks. Emerging-market governments and their private-sector allies commonly form a tight-knit—and, most of the time, genteel—oligarchy, running the country rather like a profit-seeking company in which they are the controlling shareholders.Now Johnson carefully laid the bread crumbs, but so as not to violate the rules of power player discourse, pointedly switched from the banana republic term “oligarch” to the more genteel and encompassing label “elites” when talking about the US (“elites” goes beyond the controlling interests themselves to include their operatives as well as any independent opinion influencers). Yet despite his depiction of extensive parallels between the role played by oligarchs in emerging economies and the overwhelming influence of the financial elite in the US, there’s been a peculiar sanctimonious reluctance to apply the word oligarch to the members of America’s ruling class.

When a country like Indonesia or South Korea or Russia grows, so do the ambitions of its captains of industry. As masters of their mini-universe, these people make some investments that clearly benefit the broader economy, but they also start making bigger and riskier bets. They reckon—correctly, in most cases—that their political connections will allow them to push onto the government any substantial problems that arise . . . .

In its depth and suddenness, the U.S. economic and financial crisis is shockingly reminiscent of moments we have recently seen in emerging markets (and only in emerging markets): South Korea (1997), Malaysia (1998), Russia and Argentina (time and again) . . . . But there’s a deeper and more disturbing similarity: elite business interests—financiers, in the case of the U.S.—played a central role in creating the crisis, making ever-larger gambles, with the implicit backing of the government, until the inevitable collapse. More alarming, they are now using their influence to prevent precisely the sorts of reforms that are needed, and fast, to pull the economy out of its nosedive. The government seems helpless, or unwilling, to act against them.

Some of that is that we Americans idolize our rich, and the richer the better. No one looks too hard at the fact many of our billionaires started out with a leg up, parlaying a moderate family fortune (for instance, in the case of Donald Trump) into a bigger one, or having one’s success depend on other forms of family help (Bill Gates’ mother having the connection to an IBM executive that enabled Gates to license MS-DOS to them).

But the fact that some people have advantages and are able to make the most of them, isn’t the reason to pin the “o” word on America’s top wealthy. It’s that, like Simon’s prototypical emerging market magnates, they increasingly dominate our society and are running it strictly for own self interest and devil take the rest of us. And the results on important metrics are worse than in Russia. The Gini coefficient is a widely-used measure of income inequality. The Gini coefficient is worse (higher) for the US than for Russia. Even though its rich have gotten richer and have pulled away from their lessers, the rest of the population has also done better:

In dollar terms, Russia’s GDP increased 7.5-fold over the last decade from around $200bn to $1.5 trillion; at the same time, nominal average wages increased 14-fold over the same period from $50 to around $700 a month.And the latest statistics on the Gini coefficients (at least readily findable on the Web) are a few years stale. As we’ve written, the income gains in the US from 2009 to 2011 went entirely to the top 1%, which saw a 121% increase; the rest of the population suffered a small decline. That would increase the US Gini coefficient even further.

And on top of that, the cash hoarding habits of both poor and rich Russians, and the comparative difficulty that low and moderate Americans have in escaping the strong grip of the IRS may mean the Russian wealth inequality is lower than official figures indicate. The Telegraph again:

“The proportion of mattress-stuffed money among Russia’s poor is much higher than among America’s poor, as the US tax net is so much tighter,” says Liam Halligan, chief economist at Prosperity Capital Management. “That suggests US inequality is even worse relative to Russia than the numbers suggest.”Now many readers may still recoil at the oligarch label being applied to America’s top wealthy, or Russians being much better at trickle-down economics that the plutocrats here who keep selling it despite overwhelming evidence that it isn’t operative here. But what about the celebrated John Paulson, who became a billionaire by not simply betting agains the housing market, but as we described in ECONNED, using CDOs that had the effect of pumping the bubble up bigger? Or the principals of Magnetar, whose CDO strategy played an even more direct role in extending the toxic phase of subprime lending beyond its sell by date? How about the Walton family, whose company is a welfare queen, with employees who depend on Medicare and emergency rooms for health care?

Some of the oligarch image is blunted here by the fact that the most visible members of the 1% and 0.1% are CEOs, who are increasingly chosen for their credibility with media. Their polished veneer and (in almost all cases) conventional credentials would seem to set them apart from the prototypical bad American plutocrat, the robber baron. After all, these are Peter Druckerized pinnacles of the managerial class, there by virtue of merit.

Anyone who has been inside Corporate America will tell you that merit is at most only one component in who gets ahead. As we pointed out in 2007:

Moreover, performance appraisal systems, which are the foundation for bonuses and other merit based pay, are hopelessly and intrinsically flawed. Carnegie Mellon professors Patrick D. Larkey and Jonathan P. Caulkins’ 1992 paper “All Above Average and Other Unintended Consequences of Performance Evaluation Systems,” discuss how, despite 100 years of effort, performance appraisal systems fail to achieve their intended results due to romanticized notions about how organizations work and difficulties in making comparative rankings of workers engaged in different tasks. For example, the article discussed the many ways a boss’s motivations and quirks could lead to misleading ratings.Top executives have operated in a manner that is less obviously thuggish than the violent ways of some of Russia’s richest, but the hollowing out of labor and shortened job tenures have come with high costs across broad swathes of society. And the oligarchs that Johnson singled out, the elite that control the biggest financial firms, have become singularly, systematically predatory. We discussed long from in ECONNED the scale and nature of the looting that produced the global financial crisis.

Caulkins and Larkey’s analysis showed that the idea that organizations are or can be meritocracies is a myth. Yet people have a powerful need to believe that society and the institutions they belong to are fair. These factors explain not only why increasing income

And let us not forget that people are dying thanks to bank-related abuses, even though it’s not as direct or obvious as by assassinations. On the mortgage front alone, we’ve discussed for three years how many foreclosures are simply unwarranted, some created by servicers for their own profit, many of the others unjustified because it would have been better for everyone, the borrower, the mortgage investors, the broader community, for the borrower to get a modification, but the servicer put its own bottom line first and foreclosed.

There have been cases of suicides on the eve of foreclosures, and even a courtroom death that was attributed to the stress of fighting a dubious foreclosure. But in addition to these clear cases of death by bank, there are many more cases where the financial distress of a foreclosure leads to a later suicide, or the curtailment of spending on health measures that shorten lifespans. The major servicers have blood on their hands as much, likely much more, than the demonized Russian oligarchs, but everyone here is too polite to say so out loud.

Confucius said that the beginning of wisdom was learning to call things by their proper names. The time is long past to kid ourselves about the nature of the ruling class in America and start describing it accurately, as an oligarchy.

Posted by Yves Smith at 6:59 am

No comments:

Post a Comment