How do you like knowing that the IRS already knows how much you made (legally, anyway) and could easily just tell you what they think you owe?

So much for creative accounting.

Slavery, historically, was another matter altogether.

Not to say that versions of it are not going on presently.

But at least they aren't sending ships out to collect the slaves now.

They're already here for the plucking.

What Do the Koch Brothers Really Want?

12 April 14

s a result of the disastrous Citizens United Supreme Court decision, billionaires and large corporations can now spend an unlimited amount of money to influence the political process.

Perhaps, the biggest winners of Citizens United are Charles and David Koch, owners of the second-largest privately run business in America Koch Industries.

Among other things, the Koch brothers own oil refineries in Texas, Alaska, and Minnesota and control some 4,000 miles of pipeline.

According to Forbes Magazine, the Koch brothers are now worth $80 billion, and have increased their wealth by $12 billion since last year alone.

For the Koch brothers, $80 billion in wealth, apparently, is not good enough. Owning the second largest private company in America is, apparently, not good enough. It doesn’t appear that they will be satisfied until they are able to control the entire political process.

It is well known that the Koch brothers have provided the major source of funding to the Tea Party and want to repeal the Affordable Care Act.

In 1980, David Koch ran as the Libertarian Party’s vice-presidential candidate in 1980.

Let’s take a look at the 1980 Libertarian Party platform.

Here are just a few excerpts of the Libertarian Party platform that David Koch ran on in 1980:

- “We urge the repeal of federal campaign finance laws, and the immediate abolition of the despotic Federal Election Commission.”

- “We favor the abolition of Medicare and Medicaid programs.”

- “We oppose any compulsory insurance or tax-supported plan to provide health services, including those which finance abortion services.”

- “We also favor the deregulation of the medical insurance industry.”

- “We favor the repeal of the fraudulent, virtually bankrupt, and increasingly oppressive Social Security system. Pending that repeal, participation in Social Security should be made voluntary.”

- “We propose the abolition of the governmental Postal Service. The present system, in addition to being inefficient, encourages governmental surveillance of private correspondence. Pending abolition, we call for an end to the monopoly system and for allowing free competition in all aspects of postal service.”

- “We oppose all personal and corporate income taxation, including capital gains taxes.”

- “We support the eventual repeal of all taxation.”

- “As an interim measure, all criminal and civil sanctions against tax evasion should be terminated immediately.”

- “We support repeal of all law which impede the ability of any person to find employment, such as minimum wage laws.”

- “We advocate the complete separation of education and State. Government schools lead to the indoctrination of children and interfere with the free choice of individuals. Government ownership, operation, regulation, and subsidy of schools and colleges should be ended.”

- “We condemn compulsory education laws … and we call for the immediate repeal of such laws.”

- “We support the repeal of all taxes on the income or property of private schools, whether profit or non-profit.”

- “We support the abolition of the Environmental Protection Agency.”

- “We support abolition of the Department of Energy.”

- “We call for the dissolution of all government agencies concerned with transportation, including the Department of Transportation.”

- “We demand the return of America's railroad system to private ownership. We call for the privatization of the public roads and national highway system.”

- “We specifically oppose laws requiring an individual to buy or use so-called "self-protection" equipment such as safety belts, air bags, or crash helmets.”

- “We advocate the abolition of the Federal Aviation Administration.”

- “We advocate the abolition of the Food and Drug Administration.”

- “We support an end to all subsidies for child-bearing built into our present laws, including all welfare plans and the provision of tax-supported services for children.”

- “We oppose all government welfare, relief projects, and ‘aid to the poor’ programs. All these government programs are privacy-invading, paternalistic, demeaning, and inefficient. The proper source of help for such persons is the voluntary efforts of private groups and individuals.”

- “We call for the privatization of the inland waterways, and of the distribution system that brings water to industry, agriculture and households.”

- “We call for the repeal of the Occupational Safety and Health Act.”

- “We call for the abolition of the Consumer Product Safety Commission.”

- “We support the repeal of all state usury laws.”

In other words, the agenda of the Koch brothers is not only to defund Obamacare. The agenda of the Koch brothers is to repeal every major piece of legislation that has been signed into law over the past 80 years that has protected the middle class, the elderly, the children, the sick, and the most vulnerable in this country.

It is clear that the Koch brothers and other right wing billionaires are calling the shots and are pulling the strings of the Republican Party.

And because of the disastrous Citizens United Supreme Court decision, they now have the power to spend an unlimited amount of money to buy the House of Representatives, the Senate, and the next President of the United States.

If they are allowed to hijack the American political process to defund Obamacare they will be back for more.

Tomorrow it will be Social Security, ending Medicare as we know it, repealing the minimum wage. It seems to me that the Koch brothers will not be content until they get everything they believe they are entitled to.

Hope you've finished enjoying Tax Day by now.

I've always wondered (at this time of year mainly) why the citizens (you know, the ones who control the politicians, right?) don't demand simpler tax forms as there is really no reason to have it so complicated (if you're not using the confusing tax laws/forms in order not to pay taxes).

With tax rates low enough to engender voluntary compliance (which was originally the case), why is there a need for highly paid tax professionals to fill out the fairly straightforward information in the complicated forms?

4 Ways Our Tax Dollars Pay For Rich People's Toys

14 April 14

fter losing all of my belongings in a fire, I still ended up owing the IRS a few hundred dollars. In the grand scheme of all taxes paid, that’s barely a drop in the Olympic-size swimming pool of tax revenue, yet it’s a significant cost to people in my situation.

While going through all the deductions I could claim, I was forced to leave blank all the slots available for purchasing a second home, buying a boat, drilling for oil, selling stocks, borrowing money to buy stocks, inheriting wealth, or having money in foreign bank accounts. People scraping by to make a living don’t have the money to purchase a second home or buy a few thousand shares of stock, and pay about a third of their income in taxes.

1. Frivolous Hobbies

While self-employed freelancers have to pony up nickels and dimes to pay the man, a multi-millionaire was able to write off $77,000 in deductions for a dancing horse in 2010. Romney classified his horse, Rafalca, as a "business," allowing the cost of the horse's training, stable fees, and grooming to be charged to the government. To compare, 256.6 freelancers who made $22,000 and had to write a $300 check to the Treasury Department would all pay for one extremely rich individual’s dancing horse.

2. Lavish Homes

The IRS allows people who buy million-dollar homes to qualify for the mortgage interest deduction, to where if someone borrows $1.3 million to buy a $1.5 million home, $1.1 million in interest can be deducted. As of 2009, 137,670 people qualified under those circumstances, saving $3,000 apiece.

This means $410 million in taxpayer money was spent helping 0.03 percent of the population buy a million-dollar house. If ten people like me who made $22,000 a year and had to write a $300 check to the Treasury Department combined our tax payments, all those checks would pay for one tax break for one person who bought a luxury home.

3. Inherited Fortunes

Our tax system is actually set up so people who earn their money are being bled dry so someone doesn’t have to pay a dime of tax on a gift in excess of $5 million. And the IRS is rapidly changing rules that will make taxes even more cushy on people who inherited their wealth rather than earning it through labor.

While the Bush tax cuts of 2001 exempted from estate tax all estates worth $1 million and less, the exemption cutoff has steadily grown over the last decade.

In 2010, there was no estate tax at all. When billionaire New York Yankees owner George Steinbrenner died, his heirs paid no taxes on that wealth when they inherited it, which saved them $600 million in estate taxes.

This means that when 600,000 working-class households each wrote a $1,000 check to the Treasury Department for the taxes owed on income earned from a year’s worth of hard work in 2010, all of that revenue was cancelled out so a few wealthy heirs could avoid taxes on money they never worked for.

In 2014, estates are now exempt from paying taxes on gifts of less than $5,340,000. This is a $90,000 increase from the 2013 cutoff of $5,250,000. This means 300 people like me, who had to write a check to the Treasury Department for $300, are all paying for one heir’s tax break this year.

The Congressional Budget Office found that if the estate tax were restored to pre-Bush levels, we would rake in an additional $500 billion in ten years.

This means we’re currently hemorrhaging $50 billion a year so a few rich brats don’t have to pay taxes on wealth they didn’t earn.

To compare that with the rest of America, when 50 million working people write a $1,000 check to the Treasury Department, after showing up to work every day, stressing over rising grocery and heating costs, and worrying about how to put their kids through college, all of those taxes paid are cancelled out so the nation’s wealthiest heirs don’t have to pay taxes on the tremendous wealth that they didn’t have to work one minute for.

4. Corporate Welfare

The most unjust part of our tax system is seen in the tremendous exemptions given to billion-dollar corporations. Twenty-six highly-profitable corporations in the Fortune 500 paid $0 in federal income taxes between 2008 and 2012.

Just five companies – AT&T, Verizon, Wells Fargo, IBM, and General Electric – all enjoyed $77 billion in tax breaks during that time period. This means if 10 million Americans all wrote a check to the Treasury Department for $1,540 on taxes owed for a year of hard work, every year, for five years, all of that revenue would be cancelled out by just five extremely wealthy global corporations too greedy to pay for the services they use and depend on every day.

The income tax was set up to be an equitable redistribution of wealth. People would ideally pay a portion of their income to the government, which would then redistribute it so society can function. But as our tax structure is currently working, the masses of working poor who have been working longer hours for less pay over the last several decades are redistributing their income upward, to the people who already have more than they can spend.

Working people are being pinched for pennies and threatened by audits, all so the nation’s richest one percent and most profitable corporations can have even more money than they already have.

Imagine all of the good we could do in society if corporations like Verizon and GE no longer had offshore tax havens in which to stash the profits they made in the US.

Imagine if hard work was taxed at a preferential rate, investment income was taxed at a higher rate, and inherited wealth was taxed at the highest rate. We would have all the revenue we need to create millions of good-paying jobs, high-quality education for all those who wish to learn, and a strong social safety net to support those on hard times.

America’s wealthiest parasites have been sucking on the public’s teat for long enough. It’s time we vote out their servants in November and have the equitable tax system we deserve.

(Carl Gibson, 26, is co-founder of US Uncut, a nationwide creative direct-action movement that mobilized tens of thousands of activists against corporate tax avoidance and budget cuts in the months leading up to the Occupy Wall Street movement. Carl and other US Uncut activists are featured in the documentary "We're Not Broke," which premiered at the 2012 Sundance Film Festival. He currently lives in Madison, Wisconsin. You can contact him at carl@rsnorg.org, and follow him on twitter at @uncutCG.)

The Sleazy PR Campaign to Prevent the IRS From Making Your Taxes Simpler

By Jordan Weissmann

And speaking of those who really benefited from slavery . . .

We have more than a few very famous ones here. And guess who's leading the parade of stars?

George W. Bush’s Great-Great-Great-Great-Grandfather Was a Slave Trader

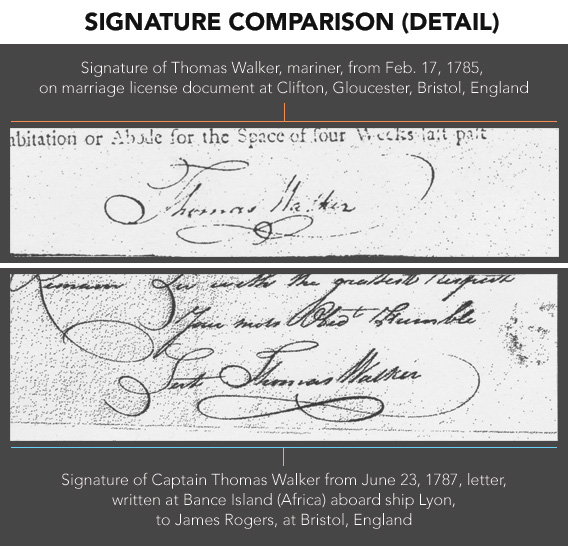

A surprising new discovery about the notorious Thomas “Beau” Walker.

“You have heard of the noted Beau Walker, an English slave trader of these parts. He arrived at the Isles Du Los [off present-day Guinea] lately in an American Brig being bound to Cape Mount [in present-day northwest Liberia] for slaves. He had scarce arrived at the last place, when exercising his usual barbarities on his officers & crew, they were provoked to conspire against him. As he lay on one of the hencoops a seaman came up & struck him on the breast with a handspike, but the blow being ill directed, did not produce its intended effect and Walker springing up wd soon have sacrificed the mutineer to his fury, had not a boy at the helm, pulling a pistol from his breast, shot him dead on the spot. His body was immediately thrown overboard. Thus ended Walker’s career, an end worthy of such a life. The vessel left Cape Mount, and it is supposed has gone for the Brazils or South Seas. There could not possibly have been a more inhuman monster than this Walker. Many a poor seaman has been brought by him to an untimely end.”

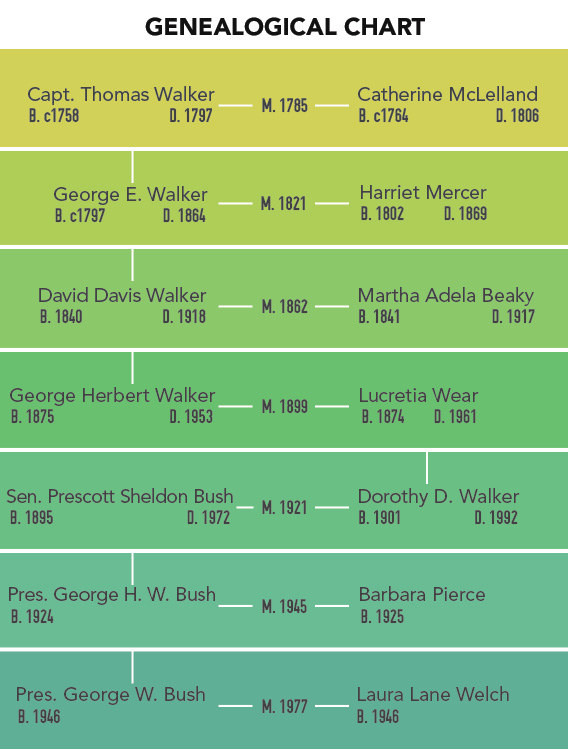

Thomas Walker and Catherine McLelland had three children, Rosetta, Thomas, and George, born between 1785 and 1797. Their younger son, George’s, descendants include the Presidents Bush. After Thomas Walker’s death, Catherine moved with the three children from Burlington, N.J., to Philadelphia, where in May 1801 she remarried to a man called Robert Hodgson. While records are scarce, it seems that Thomas Walker’s slave trading did not bestow lasting prosperity on his family. George E. Walker lost property in Maryland’s Cecil County inherited by his wife, Harriet, and the subsequent rise of the Walker family began several decades later, after they moved to Illinois in 1838.

On his 2003 visit to Goree Island, a former slave fort off the coast of the Senegalese capital, Dakar, George W. Bush denounced the slave trade as one of "the greatest crimes of history.”

"Small men took on the powers and airs of tyrants and masters," he said. "Some have said we should not judge their failures by the standards of a later time. Yet, in every time, there were men and women who clearly saw this sin and called it by name."

While Bush's distant ancestors may have been involved in exploiting African slaves, his own presidency won praise from many poverty campaigners for its work on the continent. Bush backed debt forgiveness for 21 African states, and his President's Emergency Plan for Aids Relief (PEPFAR) pumped billions of dollars into antiretroviral drugs for HIV/AIDS sufferers, saving millions of lives in Africa.

Simon Akam is a British writer. His work has appeared in the New York Times Book Review, the Times Literary Supplement, the Economist, and the New Republic.

No comments:

Post a Comment