Even if the recount of the raw votes that Bernie Sanders has called for doesn't reveal a different winner, he has still pulled off a stunning victory. Losing by less than 1/2 a percentage point is hardly a loss against the most well-known self-proclaiming winner politico in the country.

Sanders’ upset is even more notable when taken in the context of older polls. Surveys throughout the fall of 2015 predicted a Clinton victory by margins as high as 38 percent. In the summer, Clinton was expected to win by as much as 43 percent. A year ago, in February 2015, MSNBC reported a project that Clinton would win by 61 points, 68-7.

No one would have thought, when Sanders announced his campaign in May, that the wild-haired, self-proclaimed socialist would tie the former First Lady and Secretary of State in Iowa. These results are a colossal rebuke to a Democratic political establishment that has scheduled vital debates on weekends and during NFL playoff games, and poured more than $20 million in super PAC money into the election. They also represent a major win for progressives, showing that a genuine leftist candidate can be massively popular and pull an establishment candidate to the left.

The Times Endorses Hillary Clinton with a Banner Ad from Citigroup

60 Minutes Raises the Question: Are Dirty Lawyers Running the U.S.?

By Pam Martens and Russ Martens

February 1, 2016

"60 Minutes" Airs a Hidden Camera Video Showing a New York City Lawyer Explaining How Lawyers Run the County and Make Laws Preventing Them From Going to Jail

Wall Street, based in New York City, collapsed the U.S. financial system under the weight of its own corruption in 2008. We’ve just come off another year of unprecedented corruption on Wall Street, topped off with two major U.S. banks, Citigroup and JPMorgan Chase, pleading guilty to felony counts for rigging foreign currency trading.

Elsewhere in the state of New York, the heads of both legislative branches, Dean Skelos, the Senate Majority Leader, and Sheldon Silver, Speaker of the Assembly, were convicted on corruption charges in the waning days of 2015. Last evening, the CBS investigative news program, "60 Minutes," produced video evidence that 15 out of 16 lawyers in New York City were willing to discuss strategies with a potential client for laundering dirty money into the U.S. financial system through shell companies.

In short, New York State is facing an epidemic of corruption and it’s long past the time to bring in a Justice Department Taskforce to clean up the mess.

In 2013, we warned in an article at "CounterPunch" that New York was drowning in corruption; that both lawyers and judges were fixing court cases. Five years earlier, reporter Wayne Barrett wrote the following in the pages of The Village Voice, following an in-depth investigation:

“It wasn’t just that a case could be fixed. The darker secret was that the bench itself had been bought, that its polyester black robes were on a perpetual special-sale rack, that smarmy party bosses, ensconced at 16 Court Street across from the Supreme Court they ruled, demanded cash tribute to ‘make’ a judge. The district attorney, Joe Hynes, who first heard the rumor 36 years ago when he was a young prosecutor running the office’s rackets bureau, said in 2003 that he’d have to be ‘naive to think it didn’t happen,’ that it was ‘common street talk that this has been going on for eons.’”Just last February, the "New York Times" published its investigative findings on a foreign dirty money epidemic in New York City. The article looked at the luxury condos of the Time Warner Center and opened with these two revealing paragraphs:

“On the 74th floor of the Time Warner Center, Condominium 74B was purchased in 2010 for $15.65 million by a secretive entity called 25CC ST74B L.L.C. It traces to the family of Vitaly Malkin, a former Russian senator and banker who was barred from entering Canada because of suspected connections to organized crime.“Last fall, another shell company bought a condo down the hall for $21.4 million from a Greek businessman named Dimitrios Contominas, who was arrested a year ago as part of a corruption sweep in Greece.”The "Times" investigation found further that almost half of luxury homes nationwide worth at least $5 million are being purchased through shell companies.

Now, "60 Minutes" has provided the public with a close look at the logistics of the role played by ethically challenged lawyers in New York City to keep the spigot of foreign bribes flowing into the U.S. Tragically, the video evidence didn’t come from U.S. law enforcement but from a London-based nonprofit, Global Witness, which works to stop developing countries from being looted through backdoor money-laundering channels. The group found that the U.S. has an “open door” policy for receiving tainted money.

Global Witness had a man posing as a potential client make appointments with 13 New York City law firms and secretly videotaped the conversations with the 16 lawyers he met with at those firms. The Global Witness employee posed as a consultant to a Minister of Mines in a small African nation and told the lawyers that the Minister made the equivalent of a teacher’s salary in the U.S. but had accumulated enough to buy a $10 million brownstone, a $10 to $20 million Gulfstream jet and a $200 to $300 million yacht – all from “facilitating” foreign corporations in buying up mineral rights in the small African nation. Only one of the 16 lawyers refused to be a party to the money laundering. The other 15 lawyers, reports "60 Minutes," “suggested ways that the suspicious funds could be moved into the U.S. without compromising the minister’s identity.”

The standard tactics are to set up shell companies where secrecy is protected under the limited liability corporation (LLC) structure; route the money first through a series of offshore tax havens; use “straw men” as fronts for the real source of funds; and engage small U.S. money managers who “are often more flexible and understanding and less concerned about their reputation. Because they fly, to a greater extent, below the radar screen,” said one actual attorney who appears in a video.

The 60 Minutes report also notes a World Bank study that looked at 100 countries and found that the U.S. “was the favorite place for corrupt officials to set up anonymous shell companies,” other than Kenya.

The U.S. government has known for decades that money laundering was occurring at not just small money managers but at some of the largest banks on Wall Street. On November 9-10, 1999, the U.S. Senate’s Permanent Subcommittee on Investigations looked at the role of Citigroup’s retail bank, Citibank, in facilitating money laundering for foreign despots. Senator Carl Levin reported the following in his opening remarks:

“Today we are looking at the private bank of Citibank. It is the largest bank in the United States, and it has one of the largest private bank operations. It has the most extensive global presence of all U.S. banks, and it had a rogues’ gallery of private bank clients. Citibank has been private banker to:

“– Raul Salinas, brother to the former President of Mexico; now in prison in Mexico for murder and under investigation in Mexico for illicit enrichment;Citibank provided its wealthy clients with a Relationship Manager. A main focus of the hearing was on Amy G. Elliott, the Relationship Manager at Citibank who handled the Raul Salinas account.

“– Asif Ali Zardari, husband to the former Prime Minister of Pakistan; now in prison in Pakistan for kickbacks and under indictment in Switzerland for money laundering;

“– Omar Bongo, President of Gabon; subject of a French criminal investigation into bribery;

“– sons of the General Sani Abacha, former military leader of Nigeria; one of whom is now in prison in Nigeria on charges of murder and under investigation in Switzerland and Nigeria for money laundering;

“– Jaime Lusinchi, former President of Venezuela; charged with misappropriation of government funds;

“– two daughters of Radon Suharto, former President of Indonesia, who has been alleged to have looted billions of dollars from Indonesia…

“– General Albert Stroessner, former President of Paraguay and notorious for decades for a dictatorship based on terror and profiteering.”

Robert L. Roach, Counsel to the Senate investigation, testified that the Relationship Manager’s role is to function as “in-house advocates” for the interests of their clients. Roach explained the services provided to Salinas, brother to then President of Mexico, Carlos Salinas, as follows:

“The private bank…established a shell company for Mr. Salinas with layers of disguised ownership. It permitted a third party using an alias to deposit funds into the accounts, and it moved the funds out of Mexico through a Citibank concentration account that aided in the obfuscation of the audit trail. Cititrust in the Cayman Islands activated a Cayman Island shell corporation called a PIC, or private investment corporation, called Trocca, Ltd., to serve as the owner of record for the Salinas private bank accounts…In the "60 Minutes" program, one of the hidden camera videos with attorney Marc Koplik captured the essence of why New York and the U.S. are unable to dig out of the corruption epidemic. The exchange was as follows:

“Cititrust used three Panamanian shell companies to function as Trocca’s Board of Directors. Cititrust also used three Cayman Island shell companies to serve as Trocca’s officers and principal shareholders. Cititrust controls all six of these shell companies and routinely uses them to function as directors and officers of PICs that it makes available to private clients. Later, Citibank established a trust, identified only by a number, to serve as the owner of Trocca, Ltd. Raul Salinas was the secret beneficiary of the trust.

“The result of this elaborate structure was that the Salinas name did not appear anywhere on Trocca’s incorporation papers. The Trocca, Ltd. accounts were established in London and Switzerland…

“To accommodate Mr. Salinas’ desire to conceal the fact that he was moving money out of Mexico, Ms. Elliott introduced Mr. Salinas’ then-fiancée Paulina Castanon as Patricia Rios to a service officer at the Mexico City branch of Citibank. Operating under that alias, Ms. Castanon would deliver cashiers checks to the branch where they would be converted into dollars and wired into a concentration account in New York. The concentration account is a business account established by Citibank to hold funds from various destinations prior to depositing them into the proper accounts. Transferring funds through this account enables a client’s name and account number to be removed from the transaction, thereby clouding the audit trail. From there, the money would be transferred to the Trocca, Ltd. accounts in London and Switzerland…

“Between October 1992 and October 1994, more than $67 million was moved from Mexico to New York and then on to London and Switzerland by way of this system …Yet no one questioned Mr. Salinas about the origin of these funds. Far from inquiring about the sources of the funds, Ms. Elliott wrote to her colleagues in June 1993 that the Salinas account ‘is turning into an exciting, profitable one for us all. Many thanks for making me look good.’ ’’

Marc Koplik: They don’t send the lawyers to jail, because we run the country.A few weeks before the 60 Minutes program aired, the U.S. Treasury’s Financial Crimes Enforcement Network (FinCen) announced it will look at the beneficial owners behind shell companies buying up luxury real estate in two markets: Manhattan and Miami-Dade County, Florida. The information gathering will expire on August 27, 2016.

Ralph Kayser [Global Witness impersonator of a consultant for an African Minister wanting to launder money]: Do you run the country?

Marc Koplik: Still do.

Ralph Kayser: I love it.

Marc Koplik: Still do.

Albert Grant: I should say, some lawyers run the country.

Ralph Kayser: So, you are, you are some of them? Two of them?

Marc Koplik: We’re still members of a privileged, privilege class in this country.

Ralph Kayser: So, how, what does it mean you run the country? It means you?

Marc Koplik: We make the laws, and when we do so, we make them in a way that is advantageous to the lawyers.

In 2014, we took an in-depth look at how FinCen had handled the role of JPMorgan Chase in facilitating money laundering in the Bernard Madoff Ponzi scheme. It was not a pretty picture.

Engaging FinCen instead of the U.S. Justice Department is a wholly inadequate response to a crime wave being run by lawyers who believe they are above the law. And to get a U.S. Justice Department that will aggressively pursue criminals, regardless of their wealth or connections, we must first end continuity government in the Oval Office.

Democracy of the Billionaires

By Nomi Prins, "Tom Dispatch"

01 February 16

The Most Expensive Election Ever Is A Billionaire’s Playground (Except for Bernie Sanders)

peaking of the need for citizen participation in our national politics in his final State of the Union address, President Obama said, “Our brand of democracy is hard.” A more accurate characterization might have been: “Our brand of democracy is cold hard cash.”

Cash, mountains of it, is increasingly the necessary tool for presidential candidates. Several Powerball jackpots could already be fueled from the billions of dollars in contributions in play in election 2016. When considering the present donation season, however, the devil lies in the details, which is why the details follow.

With three 2016 debates down and six more scheduled, the two fundraisers with the most surprising amount in common are Bernie Sanders and Donald Trump. Neither has billionaire-infused super PACs, but for vastly different reasons. Bernie has made it clear billionaires won’t ever hold sway in his court. While Trump... well, you know, he’s not only a billionaire but has the knack for getting the sort of attention that even billions can’t buy.

Regarding the rest of the field, each candidate is counting on the reliability of his or her own arsenal of billionaire sponsors and corporate nabobs when the you-know-what hits the fan. And at this point, believe it or not, thanks to the Supreme Court’s Citizens United decision of 2010 and the super PACs that arose from it, all the billionaires aren’t even nailed down or faintly tapped out yet. In fact, some of them are already preparing to jump ship on their initial candidate of choice or reserving the really big bucks for closer to game time, when only two nominees will be duking it out for the White House.

Capturing this drama of the billionaires in new ways are TV networks eager to profit from the latest eyeball-gluing version of election politicking and the billions of dollars in ads that will flood onto screens nationwide between now and November 8th. As super PACs, billionaires, and behemoth companies press their influence on what used to be called “our democracy,” the modern debate system, now a 16-month food fight, has become the political equivalent of the NFL playoffs. In turn, soaring ratings numbers, scads of ads, and the party infighting that helps generate them now translate into billions of new dollars for media moguls.

For your amusement and mine, this being an all-fun-all-the-time election campaign, let’s examine the relationships between our twenty-first-century plutocrats and the contenders who have raised $5 million or more in individual contributions or through super PACs and are at 5% or more in composite national polls. I’ll refrain from using the politically correct phrases that feed into the illusion of distance between super PACs that allegedly support candidates’ causes and the candidates themselves, because in practice there is no distinction.

On the Republican Side:

1. Ted Cruz: Most “God-Fearing” Billionaires

Yes, it’s true the Texas senator “goofed” in neglecting to disclose to the Federal Election Commission (FEC) a tiny six-figure loan from Goldman Sachs for his successful 2012 Senate campaign. (After all, what’s half-a-million dollars between friends, especially when the investment bank that offered it also employed your wife as well as your finance chairman?) As The Donald recently told a crowd in Iowa, when it comes to Ted Cruz, “Goldman Sachs owns him. Remember that, folks. They own him.”

That aside, with a slew of wealthy Christians in his camp, Cruz has raised the second largest pile of money among the GOP candidates. His total of individual and PAC contributions so far disclosed is a striking $65.2 million. Of that, $14.28 million has already been spent. Individual contributors kicked in about a third of that total, or $26.57 million, as of the end of November 2015 -- $11 million from small donors and $15.2 million from larger ones. His five top donor groups are retirees, lawyers and law firms, health professionals, miscellaneous businesses, and securities and investment firms (including, of course, Goldman Sachs to the tune of $43,575).

Cruz’s Keep the Promise super PAC continues to grow like an action movie franchise. It includes his original Keep the Promise PAC augmented by Keep the Promise I, II, and III. Collectively, the Keep the Promise super PACs amassed $37.83 million. In terms of deploying funds against his adversaries, they have spent more than 10 times as much fighting Marco Rubio as battling Hillary Clinton.

His super PAC money divides along family factions reminiscent of Game of Thrones. A $15 million chunk comes from the billionaire Texas evangelical fracking moguls, the Wilks Brothers, and $10 million comes from Toby Neugebauer, who is also listed as the principal officer of the public charity, Matthew 6:20 Foundation; its motto is “Support the purposes of the Christian Community.”

Cruz’s super PACs also received $11 million from billionaire Robert Mercer, co-CEO of the New York-based hedge fund Renaissance Technologies. His contribution is, however, peanuts compared to the $6.8 billion a Senate subcommittee accused Renaissance of shielding from the Internal Revenue Service (an allegation Mercer is still fighting). How’s that for “New York values”? No wonder Cruz wants to abolish the IRS.

Another of Cruz’s contributors is Bob McNair, the real estate mogul, billionaire owner of the National Football League’s Houston Texans, and self-described “Christian steward.”

2. Marco Rubio: Most Diverse Billionaires

Senator Marco Rubio of Florida has raised $32.8 million from individual and PAC contributions and spent about $9 million. Despite the personal economic struggles he’s experienced and loves to talk about, he’s not exactly resonating with the nation’s downtrodden, hence his weak polling figures among the little people. Billionaires of all sorts, however, seem to love him.

The bulk of his money comes from super PACs and large contributors. Small individual contributors donated only $3.3 million to his coffers; larger individual contributions provided $11.3 million. Goldman Sachs leads his pack of corporate donors with $79,600.

His main super PAC, Conservative Solutions, has raised $16.6 million, making it the third largest cash cow behind those of Jeb Bush and Ted Cruz. It holds $5 million from Braman Motorcars, $3 million from the Oracle Corporation, and $2.5 million from Benjamin Leon, Jr., of Besilu Stables. (Those horses are evidently betting on Rubio.)

He has also amassed a healthy roster of billionaires including the hedge-fund “vulture of Argentina” Paul Singer who was the third-ranked conservative donor for the 2014 election cycle. Last October, in a mass email to supporters about a pre-Iowa caucus event, Singer promised, “Anyone who raises $10,800 in new, primary money will receive 5 VIP tickets to a rally and 5 tickets to a private reception with Marco.”

Another of Rubio's Billionaire Boys is Norman Braman, the Florida auto dealer and his mentor. These days he’s been forking over the real money, but back in 2008, he gave Florida International University $100,000 to fund a Rubio post-Florida statehouse teaching job. What makes Braman’s relationship particularly intriguing is his “intense distaste for Jeb Bush,” Rubio’s former political mentor and now political punching bag. Hatred, in other words, is paying dividends for Rubio.

Rounding out his top three billionaires is Oracle CEO Larry Ellison, who ranks third on Forbes’s billionaire list. Last summer, he threw a $2,700 per person fundraiser in his Woodside, California, compound for the candidate, complete with a special dinner for couples that raised $27,000. If Rubio somehow pulls it out, you can bet he will be the Republican poster boy for Silicon Valley.

3. Jeb Bush: Most Disappointed Billionaires

Although the one-time Republican front-runner’s star now looks more like a black hole, the coffers of “Jeb!” are still the ones to beat. He had raised a total of $128 million by late November and spent just $19.9 million of it. Essentially none of Jeb’s money came from the little people (that is, us). Barely 4% of his contributions were from donations of $200 or less.

In terms of corporate donors, eight of his top 10 contributors are banks or from the financial industry (including all of the Big Six banks). Goldman Sachs (which is nothing if not generous to just about every candidate in sight -- except of course, Bernie) tops his corporate donor chart with $192,500. His super PACs still kick ass compared to those of the other GOP contenders. His Right to Rise super PAC raised a hefty $103.2 million and, despite his disappearing act in the polls, it remains by far the largest in the field.

Corporate donors to Jeb’s Right to Rise PAC include MBF Healthcare Partners founder and chairman Mike Fernandez, who has financed a slew of anti-Trump ads, with $3.02 million, and Rooney Holdings with $2.2 million. Its CEO, L. Francis Rooney III, was the man George W. Bush appointed ambassador to the Vatican. Former AIG CEO Hank Greenberg’s current company, CV Starr (and not, as he has made pains to clarify, he himself), gave $10 million to Jeb’s super PAC. In the same Fox Business interview where he stressed that distinction, he also noted, “I’m sorry he is not living up to expectations, but that’s the reality of it.” AIG, by the way, received $182 billion in bailout money under Jeb’s brother, W.

4. Ben Carson: No Love For Billionaires

Ben Carson is running a pretty expensive campaign, which doesn’t reflect well on his possible future handling of the economy (though, as he sinks toward irrelevance in the polls, it seems as if his moment to handle anything may have passed). Having raised $38.7 million, he’s spent $26.4 million of it. His campaign received 63% of its contributions from small donors, which leaves it third behind Bernie and Trump on that score, according to FEC filings from October 2015.

His main super PACs, grouped under the title “the 2016 Committee,” raised just $3.8 million, with rich retired people providing the bulk of it. Another PAC, Our Children’s Future, didn’t collect anything, despite its pledge to turn "Carson’s outside militia into an organized army."

But billionaires aren’t Carson’s cup of tea. As he said last October, “I have not gone out licking the boots of billionaires and special-interest groups. I’m not getting into bed with them.”

Carson recently dropped into fourth place in the RealClearPolitics composite poll for election 2016 with his team in chaos. His campaign manager, Barry Bennett, quit. His finance chairman, Dean Parke, resigned amid escalating criticism over his spending practices and his $20,000 a month salary. As the rising outsider candidate, Carson once had an opportunity to offer a fresh voice on campaign finance reform. Instead, his campaign learned the hard way that being in the Republican hot seat without a Rolodex of billionaires can be hell on Earth.

5. Chris Christie: Most Sketchy Billionaires

For someone polling so low, New Jersey Governor Chris Christie has amassed startling amounts of dosh. His campaign contributions stand at $18.6 million, of which he has spent $5.7 million. Real people don’t care for him. Christie has received the least number of small contributions in either party, a bargain basement 3% of his total.

On the other hand, his super PAC, America Leads, raised $11 million, including $4.3 million from the securities and investment industry. His top corporate donors at $1 million each include Point 72 Asset Management, the Steven and Alexandra Cohen Foundation, and Winnecup Gamble Ranch, run by billionaire Paul Fireman, chairman of Fireman Capital Partners and founder and former chairman of Reebok International Ltd.

Steven Cohen, worth about $12 billion and on the Christie campaign's national finance team, founded Point 72 Asset Management after being forced to shut down SAC Capital, his former hedge-fund company, due to insider-trading charges. SAC had to pay $1.2 billion to settle.

Christie’s other helpful billionaire is Ken Langone, co-founder of Home Depot. But Langone, as he told the National Journal, is not writing a $10 million check. Instead, he says, his preferred method of subsidizing politicians is getting “a lot of people to write checks, and get them to get people to write checks, and hopefully result in a helluva lot more than $10 million.” In other words, Langone offers his ultra-wealthy network, not himself.

6. Donald Trump: I Am A Billionaire

Trump’s campaign has received approximately $5.8 million in individual contributions and spent about the same amount. Though not much compared to the other Republican contenders, it’s noteworthy that 70% of Trump’s contributions come from small individual donors (the highest percentage among GOP candidates). It’s a figure that suggests it might not pay to underestimate Trump’s grassroots support, especially since he’s getting significant amounts of money from people who know he doesn’t need it.

Last July, a Make America Great Again super PAC emerged, but it shut down in October to honor Trump’s no super PAC claim. For Trump, dealing with super PAC agendas would be a hassle unworthy of his time and ego. (He is, after all, the best billionaire: trust him.) Besides, with endorsements from luminaries like former Alaska Governor Sarah Palin and a command of TV ratings that’s beyond compare, who needs a super PAC or even his own money, of which he’s so far spent remarkably little?

On The Democratic Side:

1. Hillary Clinton: A Dynasty of Billionaires

Hillary and Bill Clinton earned a phenomenal $139 million for themselves between 2007 and 2014, chiefly from writing books and speaking to various high-paying Wall Street and international corporations. Between 2013 and 2015, Hillary Clinton gave 12 speeches to Wall Street banks, private equity firms, and other financial corporations, pocketing a whopping $2,935,000. And she’s used that obvious money-raising skill to turn her campaign into a fundraising machine.

As of October 16, 2015, she had pocketed $97.87 million from individual and PAC contributions. And she sure knows how to spend it, too. Nearly half of that sum, or $49.8 million -- more than triple the amount of any other candidate -- has already gone to campaign expenses.

Small individual contributions made up only 17% of Hillary’s total; 81% came from large individual contributions. Much like her forced folksiness in the early days of her campaign when she was snapped eating a burrito bowl at a Chipotle in her first major meet-the-folks venture in Ohio, those figures reveal a certain lack of savoir faire when it comes to the struggling classes.

Still, despite her speaking tour up and down Wall Street and the fact that four of the top six Wall Street banks feature among her top 10 career contributors, they’ve been holding back so far in this election cycle (or perhaps donating to the GOP instead). After all, campaign 2008 was a bust for her and nobody likes to be on the losing side twice.

Her largest super PAC, Priorities USA Action, nonetheless raised $15.7 million, including $4.6 million from the entertainment industry and $3.1 million from securities and investment. The Saban Capital Group and DreamWorks kicked in $2 million each.

Hillary has recently tried to distance herself from a well-deserved reputation for being close to Wall Street, despite the mega-speaking fees she’s garnered from Goldman Sachs among others, not to speak of the fact that five of the Big Six banks gave money to the Clinton Foundation. She now claims that her “Wall Street plan” is stricter than Bernie Sanders’s. (It isn’t. He’s advocating to break up the big banks via a twenty-first-century version of the Glass-Steagall Act that Bill Clinton buried in his presidency.) To top it off, she scheduled an elite fundraiser at the $17 billion “alternative investment” firm Franklin Square Capital Partners four days before the Iowa Caucus. So much for leopards changing spots.

You won’t be surprised to learn that Hillary has billionaires galore in her corner, all of whom backed her hubby through the years. Chief among them is media magnate Haim Saban who gave her super PAC $2 million. George Soros, the hedge-fund mogul, contributed $2.02 million. DreamWorks Animation chief executive Jeffrey Katzenberg gave $1 million. And the list goes on.

2. Bernie Sanders: No Billionaires Allowed

Bernie Sanders has stuck to his word, running a campaign sans billionaires. As of October 2015, he had raised an impressive $41.5 million and spent about $14.5 million of it.

None of his top corporate donors are Wall Street banks. What’s more, a record 77% of his contributions came from small individual donors, a number that seems only destined to grow as his legions of enthusiasts vote with their personal checkbooks.

According to a Sanders campaign press release as the year began, another $33 million came in during the last three months of 2015: “The tally for the year-end quarter pushed his total raised last year to $73 million from more than 1 million individuals who made a record 2.5 million donations.” That number broke the 2011 record set by President Obama’s reelection committee by 300,000 donations, and evidence suggests Sanders’s individual contributors aren’t faintly tapped out. After recent attacks on his single-payer healthcare plan by the Clinton camp, he raised $1.4 million in a single day.

It would, of course, be an irony of ironies if what has been a billionaire’s playground since the Citizens United decision became, in November, a billionaire’s graveyard with literally billions of plutocratic dollars interred in a grave marked: here lies campaign 2016.

The Media and Debates

And talking about billions, in some sense the true political and financial playground of this era has clearly become the television set with a record $6 billion in political ads slated to flood America’s screen lives before next November 8th. Add to that the staggering rates that media companies have been getting for ad slots on TV’s latest reality extravaganza -- those “debates” that began in mid-2015 and look as if they’ll never end. They have sometimes pulled in National Football League-sized audiences and represent an entertainment and profit spectacle of the highest order.

So here’s a little rundown on those debates thus far, winners and losers (and I’m not even thinking of the candidates, though Donald Trump would obviously lead the list of winners so far -- just ask him). In those ratings extravaganzas, especially the Republican ones, the lack of media questions on campaign finance reform and on the influence of billionaires is striking -- and little wonder, under the money-making circumstances.

The GOP Show

The kick-off August 6th GOP debate in Cleveland, Ohio, was a Fox News triumph. Bringing in 24 million viewers, it was the highest-rated primary debate in TV history. The follow-up at the Reagan Library in Simi Valley, California, on September 16th, hosted by CNN and Salem Radio, grabbed another 23.1 million viewers, making it the most-watched program in CNN's history. (Trump naturally took credit for that.) CNN charged up to $200,000 for a 30-second spot. (An average prime-time spot on CNN usually goes for $5,000.) The third debate, hosted by CNBC, attracted 14 million viewers, a record for CNBC, which was by then charging advertisers $250,000 or more for 30-second spots.

Fox Business News and the Wall Street Journal hosted the next round on November 10th: 13.5 million viewers and (ho-hum) a Fox Business News record. For that one, $175,000 bought you a 30-second commercial slot.

The fifth and final debate of 2015 on December 15th in Las Vegas, again hosted by CNN and Salem Radio, lassoed 18 million viewers. As 2016 started, debate fatigue finally seemed to be setting in. The first debate on January 14th in North Charleston, South Carolina, scored a mere 11 million viewers for Fox Business News. When it came to the second debate (and the last before the Iowa caucuses) on January 28th, The Donald decided not to grace it with his presence because he didn't think Fox News had treated him nicely enough and because he loathes its host Megyn Kelly.

The Democratic Debates

Relative to the GOP debate ad-money mania, CNN charged a bargain half-off, or $100,000, for a 30-second ad during one of the Democratic debates. Let’s face it, lacking a reality TV star at center stage, the Democrats and associated advertisers generally fared less well. Their first debate on October 13th in Las Vegas, hosted by CNN and Facebook, averaged a respectable 15.3 million viewers, but the next one in Des Moines, Iowa, overseen by CBS and the Des Moines Register, sank to just 8.6 million viewers. Debate number three in Manchester, New Hampshire, hosted by ABC and WMUR, was rumored to have been buried by the Democratic National Committee (evidently trying to do Hillary a favor) on the Saturday night before Christmas. Not surprisingly, it brought in only 7.85 million viewers.

The fourth Democratic debate on NBC on January 17th (streamed live on YouTube) featured the intensifying battle between an energized Bernie and a spooked Hillary. It garnered 10.2 million TV viewers and another 2.3 million YouTube viewers, even though it, too, had been buried -- on the Sunday night before Martin Luther King, Jr. Day. In comparison, 60 Minutes on rival network CBS nabbed 20.3 million viewers.

The Upshot

So what gives? In this election season, it’s clear that these skirmishes involving the ultra-wealthy and their piles of cash are transforming modern American politics into a form of theater. And the correlation between big money and big drama seems destined only to rise. The media needs to fill its coffers between now and election day and the competition among billionaires has something of a horse-betting quality to it. Once upon a time, candidates drummed up interest in their policies; now, their policies, such as they are, have been condensed into so many buzzwords and phrases, while money and glitz are the main currencies attracting attention.

That said, it could all go awry for the money-class and wouldn’t that just be satisfying to witness -- the irony of an election won not by, but despite, all those billionaires and corporate patrons.

Will Bernie’s citizens beat Hillary’s billionaires? Will Trump go billion to billion with fellow New York billionaire Michael Bloomberg? Will Cruz’s prayers be answered? Will Rubio score a 12th round knockout of Cruz and Trump? Does Jeb Bush even exist? And to bring up a question few are likely to ask: What do the American people and our former democratic republic stand to lose (or gain) from this spectacle? All this and more (and more and more money) will be revealed later this year.

Hedrick Smith

What Fires Anger in Grass Roots America?

Washington

If you want to see what fires the grass roots passion for Donald Trump and Bernie Sanders and the populist rebellion against the U.S corporate and political elite, take a look at the latest case of an American corporation’s gaming the system for handouts and bailouts and then walking out on Uncle Sam and all of us.

Back in 2009, Johnson Controls, a $33 billion maker of auto batteries and industrial-scale HVAC systems, wound up with a $100 million chunk of the federal bailout for the auto industry. In 2010, it got another $300 million federal grant to develop advanced battery systems. But now, Johnson Controls wants to duck out on U.S. taxes by renouncing its U.S. citizenship and shifting its legal residence to Ireland.

Like nearly 50 other U.S. multi-national corporations over the past decade, Johnson Controls can dodge U.S. taxes legally through a corporate inversion – merging with a foreign ompany, Tyco International, based in Cork, Ireland. Tyco, too, was once a U.S. company based in New Jersey but in 1997, it skipped out on U.S. taxes by merging with a foreign firm based in Bermuda.

Johnson Controls says it will save $150 million a year in U.S. taxes. And its CEO, Alex Molinaroli, gets a sweetheart payout of $20.5 million to $79.6 million over the next 18 months for making the deal. And if Molinaroli has to pay additional taxes as a result, the company will pay those taxes for him.Crony Capitalism at Work

Oh, for instant replay in politics! You have to wonder if Congress had known this back in December 2008, how members would have reacted to the hard sell for an $80 billion auto industry bailout from former Johnson Controls President Keith Wandell, representing a major auto supplier.

“Speaking for our company, and, I am sure for all auto parts suppliers,” Wendell told the Senate Banking Committee, “we respectfully urge the members of this committee, and the Congress as a whole, to provide the financial support the automakers need at this critical time.” The collapse of even one U.S. carmaker, Wandell warned, would send shock waves through in the auto parts industry, spreading wars of layoffs..

Source (CC): Argonne National Laboratory

Fast forward to 2011 and once again Johnson Controls was benefitting from a big federal grant to help it build and run an advanced lithium ion battery plant in Holland, Michigan. Visiting the plant, President Obama hailed the company as a technology leader and then made the point that America’s ability to sponsor private sector innovation means that“everybody’s got to chip in” and that means “making sure that the biggest corporations pay their fair share in taxes.”

Steep Drop in Corporate Share of Tax Revenues

Obviously, that message fell on deaf ears. Johnson Controls has just become the 13th major U.S. corporation in the last 16 months to cut its tax bill through a foreign merger. Even before this latest wave, the Treasury Department estimated that corporate inversions will cost Uncle Sam $41 billion in lost tax revenues over the next decade.

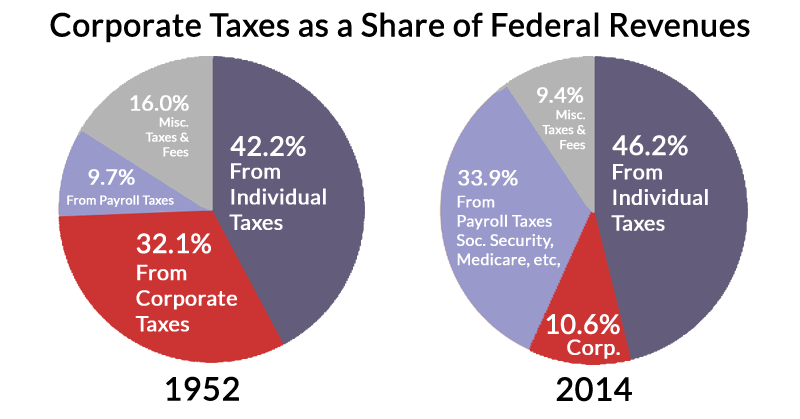

But in truth, the corporate inversion game is just the latest strategem in a long-term trend that has eroded America’s corporate tax base. Since the 1950s, the corporate share of federal tax revenues has fallen steeply from over 30% to just 10% percent today – thanks, not only to a lower corporate tax rate but to $1.2 trillion in corporate tax loopholes passed by Congress.

Source: OMB – Changing Composition of Federal Tax Revenues

One reason is that foreign tax havens have become the new norm for Corporate America. Major multi-nationals find financial hideaways like Bermuda or the Cayman islands where they set up shell affiliates, often little more than an small office with a big bank account, where they can stash their overseas profits and escape U.S. taxes.

In 2014, nearly three-fourths of Fortune 500 companies booked profits to foreign tax havens, according to a study by Citizens for Tax Justice and US PIRG. In all, U.S. companies were hoarding $2.1 trillion in profits offshore – enough to generate $620 billion in U.S. taxes if all those foreign earnings had come back home.

Johnson Controls Triggers Campaign Backlash

Much of that corporate tax dodging flies under the media radar. But the Johnson Controls action, quickly following Pfizer, Medtronics, Mylan and C&J Energy, has suddenly made corporate inversions a campaign issue. Democrat Bernie Sanders, broadly attacking “corporate deserters,” zeroed in on Johnson Controls for taking taxpayer money and then ducking taxes. “Profitable companies that have received corporate welfare from American taxpayers,” Sanders declared, “should not be allowed to renounce their U.S. citizenship to avoid paying U.S. taxes.”

Donald Trump, with Republican business credentials, concedes that “we have a huge inversion problem” because some corporate CEOs “have no loyalty to this country” and Congress has failed to take action.Hillary Clinton, denouncing “efforts to shirk U.S. tax obligations (that) leave American taxpayers holding the bag while corporations juice more revenues and profits,” has called for “an exit tax” on corporations that leave the country to lower their tax bill.

But so far on Capitol Hill, Corporate America has blocked reform.

How Big Business Blocked Corporate Tax Reform

The most promising push for corporate tax reform in Congress in recent years began with strong corporate backing and was painstakingly crafted in 2014 by Michigan Republican Congressman Dave Camp, a pro-business conservative who then chaired the powerful House Ways and Means Committee.

Former Rep. Dave Camp, (R-Mich.) authored major tax reform plan but got shot down by his former corporate supporters. (CC) House GOP

For years, business leaders had clamored for a cut in the corporate tax rate and Camp complied, proposing a cut from 35% to 25%. To raise revenues to offset that cut, Camp proposed closing some big corporate tax loopholes, including the tax exemption on overseas earnings, which would have undercut inversions.

Two days after unveiling his tax plan in February 2014, Camp flew to Park City Utah expecting to be feted at a big campaign fund-raiser attended by major corporate lobbyists. Instead, Camp ran into a buzz saw of opposition. Suddenly, the corporate lobbyists who had pushed him into tax reform were angry at him for wanting to close their loopholes. Within days, they had jawboned 50 congressional Republicans to publicly oppose Camp’s bill.

Corporate opposition killed Camp’s reform plan before it got off the ground, and Camp’s shipwreck became an object lesson for Congress on Corporate America’s ability to block action on tax issues. And the flood of corporate campaign contributions into congressional races, so far little noticed by the media, is aimed largely at protecting the legal tax dodges of America’s richest corporations.

No comments:

Post a Comment