(Please consider making even a small contribution to the Welcome to Pottersville2 Quarterly Fundraiser happening now ($5.00 is suggested for those on a tight budget) or at least sending a link to your friends if you think the subjects discussed here are worth publicizing. Thank you for your support. We are in a real tight spot financially right now and would sincerely appreciate any type of contribution. Anything you can do will make a huge difference in this blog's ability to survive in these difficult economic times.)

Taibbi/Spitzer/Kelleher ‘Cartel- Corruption’ Behind Libor Scam

06 Jul 2012

“Viewpoint” host Eliot Spitzer, Matt Taibbi, Rolling Stone contributing editor, and Dennis Kelleher, president and CEO of Better Markets, analyze the Libor interest rate–rigging scandal engulfing the banking industry.

Barclays CEO Bob Diamond recently resigned after the bank was fined $453 million for its part in the scandal, which involved manipulating the London Interbank Offered Rate (Libor), a key global benchmark for interest rates, by essentially “faking their credit scores,” according to Taibbi. And as Taibbi explains, Barclays couldn’t have acted alone.

“It can’t just be Barclays and the Royal Bank of Scotland. In fact, it can’t even be four banks or even five banks,” he says. “Really, in the end it’s probably going to come out that it’s going to be all of them … involved in this. And that’s what’s critical for people to understand: that this is a cartel-style corruption.”

Kelleher argues that the Libor scandal is proof that the financial industry “is corrupt and rotten to its core.” “The same executives [using] the same business model that crashed the entire financial system in ’08 are still running these banks,” he says.

Comments:

Blissex Says:

As Sreve Waldman and others show the “prime rate” in the USA has been “managed” by USA banks and the Fed/regulators to greatly boost bank lending profits to individuals, to allow them a cushion when they have trading losses:

“the spread between the Federal funds (and Treasury bill) rate and the prime rate widened from 1 1/2% to 3% in 1991. That was Greenspan’s gift to the banking sector to insure that major banks would not fail. You may recall at the time that rumors were rife — including some repeaed on the floor of the House — that Citibank was about to go under. By doubling the margin between the prime and the funds rate — and essentially increasing the profitability fourfold after taking into consideration the costs of processing loans”

Blissex Says:

«the scandal is that the banks are actually treating their LIBOR submissions as game theoretic moves to maximize their advantage.»

So if I understand the real issue correctly, it’s that in a contract tied to LIBOR between an entity that can influence the LIBOR rate and an entity that can’t, we can expect the LIBOR entity to on average have the upper hand.»

Not in an individual sense, but in the aggregate yes. Note that the LIBOR was underreportred thus giving a discount on interest rates to those who borrowed from the banks at LIBOR plus a spread.

But of course banks were trying to hide their insolvency, because LIBOR is in effect also an indicator of the insolvency risk of a bank, and thus underreporting LIBOR made banks in aggregate look better and thus able to postpone insolvency and to pay less for credit default swaps on each other.

Ever wonder where the money has flown to? Seems like we're the last to know (everyone else has already moved toward these areas, of course).

Rise Of The New Rich

06 Jul 2012

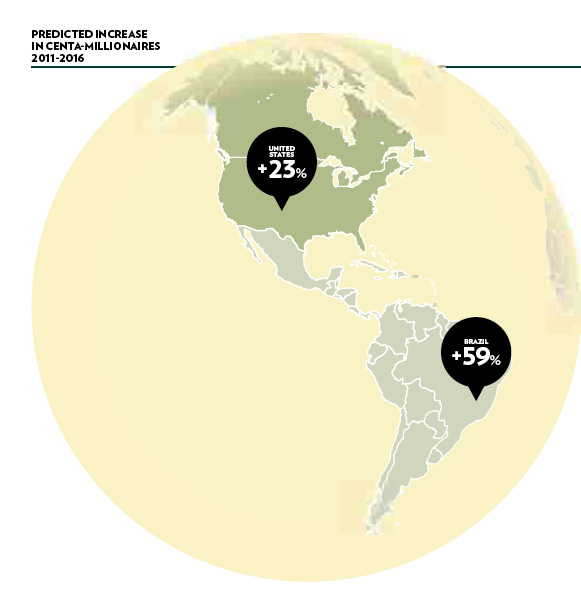

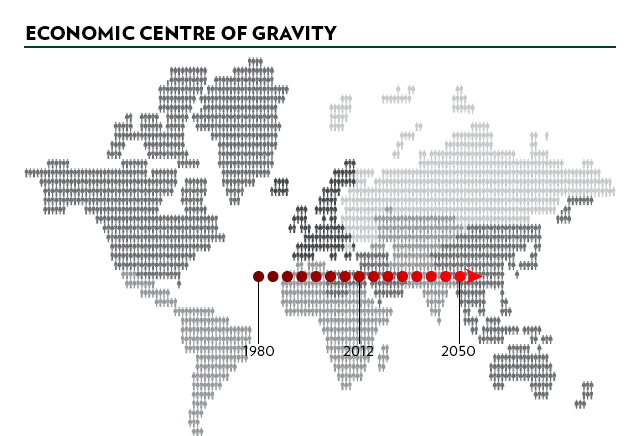

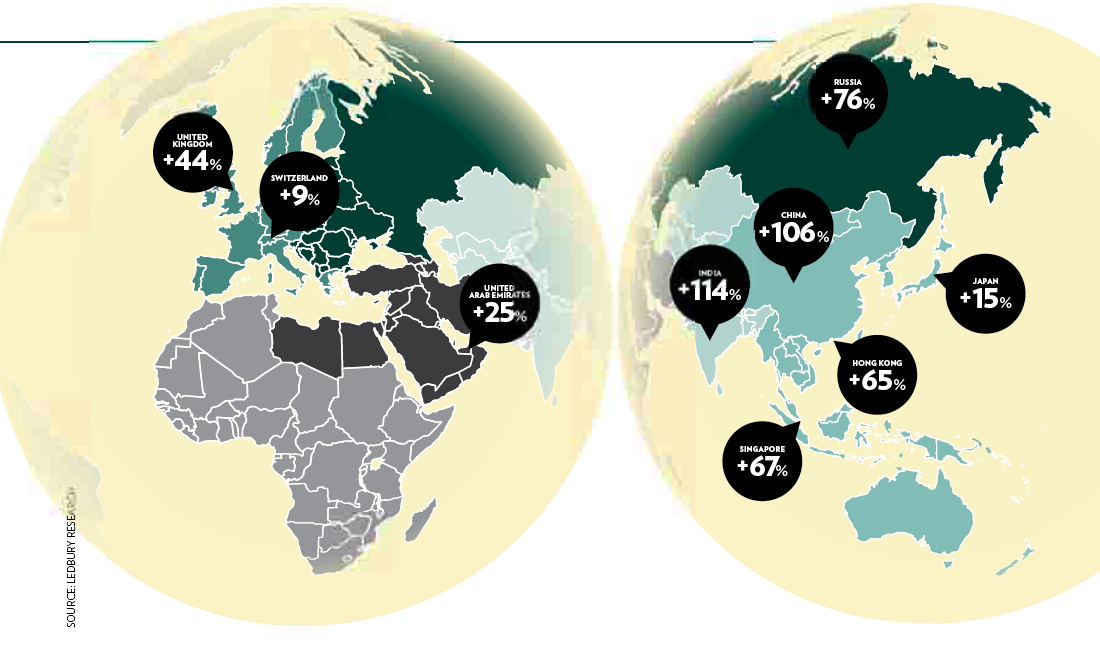

The distribution of the world’s super-rich is shifting. Grainne Gilmore seeks out future global wealth hotspots and discovers it’s not all about China.

Click to enlarge:

London School of Economics professor Danny Quah has calculated that the world’s economic centre of gravity – the average location of economic activity by GDP – is on the move. By 2050, the steady rise of emerging economies in Asia will have pushed the theoretical centre of gravity modelled by Professor Quah from its location in 1980 in the Atlantic Ocean to somewhere between China and India by 2050. He predicts that political influence will follow a similar trajectory eastwards.

˜˜˜

˜˜˜

˜˜˜

Source:

The Wealth Report 2012

A Global Perspective On Prime Property And Wealth

So, are we waking up from this 30-year nightmare yet?

Most neutral observers would agree that Mitt Romney's Bain-ful business practices are fair game for consideration as far as whom they ultimately benefit - the U.S. or just the financiers (not to mention their highly-questionable ethics component).

. . . however much the Romney campaign may wish otherwise, the nature of that business career is fair game. How did Mr. Romney make all that money? Was it in ways suggesting that what was good for Bain Capital, the private equity firm that made him rich, would also be good for America?

And the answer is no.

The truth is that even if Mr. Romney had been a classic captain of industry, a present-day Andrew Carnegie, his career wouldn’t have prepared him to manage the economy. A country is not a company (despite globalization, America still sells 86 percent of what it makes to itself), and the tools of macroeconomic policy — interest rates, tax rates, spending programs — have no counterparts on a corporate organization chart. Did I mention that Herbert Hoover actually was a great businessman in the classic mold?

In any case, however, Mr. Romney wasn’t that kind of businessman. Bain didn’t build businesses; it bought and sold them. Sometimes its takeovers led to new hiring; often they led to layoffs, wage cuts and lost benefits. On some occasions, Bain made a profit even as its takeover target was driven out of business. None of this sounds like the kind of record that should reassure American workers looking for an economic savior.

And then there’s the business about outsourcing.

Two weeks ago, The Washington Post reported that Bain had invested in companies whose specialty was helping other companies move jobs overseas. The Romney campaign went ballistic, demanding — unsuccessfully — that The Post retract the report on the basis of an unconvincing “fact sheet” consisting largely of executive testimonials.

What was more interesting was the campaign’s insistence that The Post had misled readers by failing to distinguish between “offshoring” — moving jobs abroad — and “outsourcing,” which simply means having an external contractor perform services that could have been performed in-house.

Now, if the Romney campaign really believed in its own alleged free-market principles, it would have defended the right of corporations to do whatever maximizes their profits, even if that means shipping jobs overseas. Instead, however, the campaign effectively conceded that offshoring is bad but insisted that outsourcing is O.K. as long as the contractor is another American firm.

That is, however, a very dubious assertion.

Consider one of Mr. Romney’s most famous remarks: “Corporations are people, my friend.” When the audience jeered, he elaborated: “Everything corporations earn ultimately goes to people. Where do you think it goes? Whose pockets? Whose pockets? People’s pockets.” This is undoubtedly true, once you take into account the pockets of, say, partners at Bain Capital (who, I hasten to add, are, indeed, people). But one of the main points of outsourcing is to ensure that as little as possible of what corporations earn goes into the pockets of the people who actually work for those corporations.

Why, for example, do many large companies now outsource cleaning and security to outside contractors? Surely the answer is, in large part, that outside contractors can hire cheap labor that isn’t represented by the union and can’t participate in the company health and retirement plans. And, sure enough, recent academic research finds that outsourced janitors and guards receive substantially lower wages and worse benefits than their in-house counterparts.

Just to be clear, outsourcing is only one source of the huge disconnect between a tiny elite and ordinary American workers, a disconnect that has been growing for more than 30 years. And Bain, in turn, was only one player in the growth of outsourcing. So Mitt Romney didn’t personally, single-handedly, destroy the middle-class society we used to have. He was, however, an enthusiastic and very well remunerated participant in the process of destruction; if Bain got involved with your company, one way or another, the odds were pretty good that even if your job survived you ended up with lower pay and diminished benefits.

In short, what was good for Bain Capital definitely wasn’t good for America.

2 comments:

I hope Shillary reads this piece. Reparations? Try starting with Haditha and Kandahar.

Good luck with that, huh?

Reparations? I'd like to see some go to the ones who mistakenly voted for them.

But I'm just a cynic now, you know.

Old, poor and terminally unemployed.

And, no, no hope for the great Obama's coming "changes" (after we help him win the next election, of course).

(Except for the dim hope that his coming compromises on Social Security/Medicare/Medicaid don't actually do me in once and for all.)

Wish he'd do something to discynicalize me.

Post a Comment