(Please consider making even a small contribution to the Welcome to Pottersville2 Quarterly Fundraiser happening now ($5.00 is suggested for those on a tight budget) or at least sending a link to your friends if you think the subjects discussed here are worth publicizing. Thank you for your support. We are in a real tight spot financially right now and would sincerely appreciate any type of contribution. Anything you can do will make a huge difference in this blog's ability to survive in these difficult economic times.)

"America's not the greatest country in the world anymore."

And here's why:

Here's Papantonio and Cliff Schecter on Ring of Fire Radio talking felonies, Romney, Bain and the Tea Party love of all three.A good discussion throughout. Watch:

Money quote (at 1:51 in the clip below):

This man [Romney] will be running the country if he is elected, and we need to know that he has that frigging criminal side to him. Let's not cover it what it is. He has a criminal side to hm.

I swear I didn't want to run another PC Roberts exposé, but he is just too fine an analyst (not to mention his cohort Nomi Prins). Don't miss it.

But first:

The Real Libor Scandal

Paul Craig Roberts and Nomi Prins

July 14, 2012

Paul Craig Roberts

According to news reports, UK banks fixed the London interbank borrowing rate (Libor) with the complicity of the Bank of England (UK central bank) at a low rate in order to obtain a cheap borrowing cost. The way this scandal is playing out is that the banks benefitted from borrowing at these low rates. Whereas this is true, it also strikes us as simplistic and as a diversion from the deeper, darker scandal.

Banks are not the only beneficiaries of lower Libor rates. Debtors (and investors) whose floating or variable rate loans are pegged in some way to Libor also benefit. One could argue that by fixing the rate low, the banks were cheating themselves out of interest income, because the effect of the low Libor rate is to lower the interest rate on customer loans, such as variable rate mortgages that banks possess in their portfolios.

But the banks did not fix the Libor rate with their customers in mind. Instead, the fixed Libor rate enabled them to improve their balance sheets, as well as help to perpetuate the regime of low interest rates. The last thing the banks want is a rise in interest rates that would drive down the values of their holdings and reveal large losses masked by rigged interest rates.

Indicative of greater deceit and a larger scandal than simply borrowing from one another at lower rates, banks gained far more from the rise in the prices, or higher evaluations of floating rate financial instruments (such as CDOs), that resulted from lower Libor rates.

As prices of debt instruments all tend to move in the same direction, and in the opposite direction from interest rates (low interest rates mean high bond prices, and vice versa), the effect of lower Libor rates is to prop up the prices of bonds, asset-backed financial instruments, and other “securities.” The end result is that the banks’ balance sheets look healthier than they really are.

On the losing side of the scandal are purchasers of interest rate swaps, savers who receive less interest on their accounts, and ultimately all bond holders when the bond bubble pops and prices collapse.

We think we can conclude that Libor rates were manipulated lower as a means to bolster the prices of bonds and asset-backed securities. In the UK, as in the US, the interest rate on government bonds is less than the rate of inflation. The UK inflation rate is about 2.8%, and the interest rate on 20-year government bonds is 2.5%. Also, in the UK, as in the US, the government debt to GDP ratio is rising. Currently the ratio in the UK is about double its average during the 1980-2011 period.

The question is, why do investors purchase long term bonds, which pay less than the rate of inflation, from governments whose debt is rising as a share of GDP? One might think that investors would understand that they are losing money and sell the bonds, thus lowering their price and raising the interest rate.

Why isn’t this happening?

PCR’s June 5 column, “Collapse at Hand,” explained that despite the negative interest rate, investors were making capital gains from their Treasury bond holdings, because the prices were rising as interest rates were pushed lower.

What was pushing the interest rates lower?

The answer is even clearer now. First, as PCR noted, Wall Street has been selling huge amounts of interest rate swaps, essentially a way of shorting interest rates and driving them down. Thus, causing bond prices to rise.

Secondly, fixing Libor at lower rates has the same effect. Lower UK interest rates on government bonds drive up their prices.

In other words, we would argue that the bailed-out banks in the US and UK are returning the favor that they received from the bailouts and from the Fed and Bank of England’s low rate policy by rigging government bond prices, thus propping up a government bond market that would otherwise, one would think, be driven down by the abundance of new debt and monetization of this debt, or some part of it.

How long can the government bond bubble be sustained? How negative can interest rates be driven?

Can a declining economy offset the impact on inflation of debt creation and its monetization, with the result that inflation falls to zero, thus making the low interest rates on government bonds positive?

According to his public statements, zero inflation is not the goal of the Federal Reserve chairman. He believes that some inflation is a spur to economic growth, and he has said that his target is 2% inflation. At current bond prices, that means a continuation of negative interest rates.

The latest news completes the picture of banks and central banks manipulating interest rates in order to prop up the prices of bonds and other debt instruments. We have learned that the Fed has been aware of Libor manipulation (and thus apparently supportive of it) since 2008. Thus, the circle of complicity is closed. The motives of the Fed, Bank of England, US and UK banks are aligned, their policies mutually reinforcing and beneficial. The Libor fixing is another indication of this collusion.

Unless bond prices can continue to rise as new debt is issued, the era of rigged bond prices might be drawing to an end. It would seem to be only a matter of time before the bond bubble bursts.

(Nomi Prins is author of It Takes A Pillage and a former managing director of Goldman Sachs. Paul Craig Roberts [paulcraigroberts@yahoo.com] was Assistant Secretary of the Treasury during President Reagan’s first term. He was Associate Editor of the Wall Street Journal. He has held numerous academic appointments, including the William E. Simon Chair, Center for Strategic and International Studies, Georgetown University, and Senior Research Fellow, Hoover Institution, Stanford University. He was awarded the Legion of Honor by French President Francois Mitterrand. He is the author of Supply-Side Revolution : An Insider’s Account of Policymaking in Washington; Alienation and the Soviet Economy and Meltdown: Inside the Soviet Economy, and is the co-author with Lawrence M. Stratton of The Tyranny of Good Intentions: How Prosecutors and Bureaucrats Are Trampling the Constitution in the Name of Justice. Click here for Peter Brimelow’s Forbes Magazine interview with Roberts about the recent epidemic of prosecutorial misconduct.)

Another one bites the dust? Not really, just another plea copper.

Peregrine Chief Arrested for Lying to Regulators

The head of collapsed US futures broker Peregrine Financial Group was arrested Friday on criminal charges, days after he apparently attempted suicide and confessed to fraud in a signed statement.

Russell Wasendorf, the sole owner and chief executive of Iowa-based PFG, admitted in the suicide note that he had embezzled millions of dollars from clients over 20 years.

The company’s accounts have a shortfall of about $200 million, according to a US regulator who sued the company Tuesday.

And on the homefront (just kidding, only if your home is London - and you're an American werewolf) . . . .

Caught with its hand in the cookie jar, Barclay’s agreed to pay nearly half a billion in fines to British and American authorities, and as many as 20 other megabanks are under investigation, including Deutsche Bank, Citigroup, UBS, HSBC, and JPMorgan Chase. As one MIT authority on finance told CNN, “This dwarfs by orders of magnitude any financial scams in the history of markets.”

In the middle of this mess is an American named Bob Diamond. He was the CEO of Barclays and the man behind Barclays’ takeover of what was left of Lehman Brothers when, at the height of the financial crisis in 2008, Lehman filed for the largest bankruptcy in U.S. history.

His goal was to make Barclays a global investment powerhouse but his enormous salary — his net worth has been estimated at $165 million — and unrepentant defense of the financial industry’s behavior led one British government official to describe him as “the unacceptable face of banking.” Diamond did wind up apologizing for Barclay’s role in the Libor interest rate scandal, even offering to forfeit his annual bonus — last year he received one worth more than $4 million. But in the end, under pressure from stockholders and public opinion, he was forced to resign.

Meanwhile, the ripples from the scandal continue to spread. The New York Times reports that the city of Baltimore, stricken by financial losses and layoffs, is in the midst of a court battle against the banks that set the Libor index and that, “Now cities, states and municipal agencies nationwide, including Massachusetts, Nassau County on Long Island, and California’s public pension system, are looking at whether they suffered similar losses and are weighing legal action…

Banksters Take Us to the Brink

By Bill Moyers and Michael Winship, Bill Moyers & Company

13 July 12

very day brings more reminders of the terrible unfairness that besets our country, the tragic reversal of fortune experienced by millions who once had good lives and steady jobs, now gone.

An article in the current issue of Rolling Stone chronicles “The Fallen: The Sharp, Sudden Decline of America’s Middle Class” and describes a handful of middle class men and women made homeless, forced to live out of their cars in church parking lots in Southern California.

One of them, Janis Adkins, drove a van filled with her belongings to Santa Barbara, where she panhandled at an intersection with a sign reading, “I’d Rather Be Working — Hire Me If You Have a Job.” Once upon a time she had a successful plant nursery business in Utah that annually grossed $300,000. But two years after the nation’s financial meltdown her sales had dropped by fifty percent and the value of her land plunged even more. She tried to refinance but four banks turned her down flat. “Everyone was talking about bailouts,” Adkins told reporter Jeff Tietz. “I said, ‘I’m not asking for a bailout, I’m asking you to work with me.’ They look at you, no expression on their faces, saying, ‘There’s nothing we can do.’”

“Nothing we can do.” And yet it was banks like these who helped get people like Janis Adkins into such desperate jams in the first place. When faced with their own financial catastrophes, all those big-time bankers came running to the government and taxpayers for those aforementioned bailouts worth hundreds of billions of dollars, then scooped up big bonuses and perks for themselves, and went back to business as usual.

And what a business! You’ve most likely been hearing about the newest scandal in banking, centering on Barclays Bank in Great Britain and something called Libor. That stands for London Interbank Offered Rate, and involves a group of bankers who set a daily interest rate affecting trillions of dollars of transactions around the world. Your home mortgage, your college debt, your credit card fees; all of these could have been affected by Libor.

Now you would think the rates would be set by market forces, right? Aren’t they what makes the world go ‘round? But it turns out some of those insiders were manipulating the index for their own gain, to make their banks look better off during the financial crisis, lower their borrowing costs, and raise their profits — by cheating. Picking our pockets and lining theirs.

The Economist describes it as “the rotten heart of finance.” Here are some of the e-mails that have come to light: A banker in on the fix writes another, “Dude. I owe you big time! Come over one day after work and I’m opening a bottle of Bollinger.” One employee after being asked to submit false information, answered: “Always happy to help.” And another, recruiting a colleague in the fix, wrote: “If you know how to keep a secret, I’ll bring you in on it.”

Caught with its hand in the cookie jar, Barclay’s agreed to pay nearly half a billion in fines to British and American authorities, and as many as 20 other megabanks are under investigation, including Deutsche Bank, Citigroup, UBS, HSBC, and JPMorgan Chase. As one MIT authority on finance told CNN, “This dwarfs by orders of magnitude any financial scams in the history of markets.”

In the middle of this mess is an American named Bob Diamond. He was the CEO of Barclays and the man behind Barclays’ takeover of what was left of Lehman Brothers when, at the height of the financial crisis in 2008, Lehman filed for the largest bankruptcy in U.S. history. His goal was to make Barclays a global investment powerhouse but his enormous salary — his net worth has been estimated at $165 million — and unrepentant defense of the financial industry’s behavior led one British government official to describe him as “the unacceptable face of banking.”

Diamond did wind up apologizing for Barclay’s role in the Libor interest rate scandal, even offering to forfeit his annual bonus — last year he received one worth more than $4 million. But in the end, under pressure from stockholders and public opinion, he was forced to resign.

Meanwhile, the ripples from the scandal continue to spread. The New York Times reports that the city of Baltimore, stricken by financial losses and layoffs, is in the midst of a court battle against the banks that set the Libor index and that, “Now cities, states and municipal agencies nationwide, including Massachusetts, Nassau County on Long Island, and California’s public pension system, are looking at whether they suffered similar losses and are weighing legal action…

“American municipalities have been among the first to claim losses from the supposed rate-rigging, because many of them borrow money through investment vehicles that directly derive their value from Libor. Peter Shapiro, who advises Baltimore and other cities on their use of these investments, said that ‘about 75 percent of major cities have contracts linked to this.’”What’s more, indications are that government agencies like the Bank of England and the British treasury also may have been involved, or at least looked the other way, raising questions whether other government agencies – including our own Federal Reserve — may have played a role. That remains for the investigators to find out but according to The Washington Post, the Federal Reserve Bank of New York said “it had received word as early as 2007 from the British bank Barclays about problems” with Libor.

“In testimony last week before the British Parliament, former Barclays chief executive Robert E. Diamond said the bank had repeatedly brought to the attention of U.S. regulators — as well as U.K. regulators — the problems that the bank was experiencing in the Libor market… He said the bank’s warnings to regulators that Libor was artificially low did not lead to action. Barclays’ regulator in the United States is the Federal Reserve Bank of New York, which was run at the time by current Treasury Secretary Timothy F. Geithner.”

This week the Senate Banking Committee asked for meetings with the principals involved and the House Financial Services Committee sent a letter to the New York Fed asking for transcripts of a dozen phone calls with Barclays executives.

But how far will inquiries go, especially when both American political parties are so beholden to high finance for cash? Just hours after Bob Diamond’s resignation, Mitt Romney’s campaign announced that, sadly, the disgraced financier would no longer be hosting one of two Romney fundraising events for American expatriates being held in London later this month. But no worries. The Boston Globe notes that “still among those hosting the events is Patrick Durkin, a registered lobbyist for Barclays… Durkin, who has been a top Romney bundler, is one of seven chairs for the reception and among the 13 co-chairs for the dinner.”

“Others involved in hosting the events are Dwight Poler, managing director at the European branch of Bain Capital, the firm Romney founded; Raj Bhattacharyya, managing director at Deutsche Bank; and Dan Bricken, a managing director at Wells Fargo Securities.”Each guest at the dinner event will pay between $25,000 and $75,000 for the opportunity to sup with the Republican presidential nominee.

The non-partisan Center for Responsive Politics (OpenSecrets.org) reports that through the end of May, Bob Diamond and other Barclays employees had donated nearly a quarter of a million dollars to the Romney campaign, and of course, the entire securities and investment industry has been a major donor to the Republican — more than any other. They’re giving to President Obama, too; just not as much, although they’re Number 3 on the list of top ten interest groups sending cash to the president and the Democratic National Committee.

And you wonder why the banksters still roam free, like gunslingers in a Wild West town without a sheriff.

I know. I know. You didn't even want to consider those special liars about the housing market recovery yet, did you? I became quite unpopular a couple of months ago as I toured a development for retired folks with half-million-dollar pricetags for two-bedroom apartments (I know, but stay with me here) and told the wide-eyed and hopeful realtor lady that "you know the market is getting ready to go down another third to a half, based on the economic data, right?"

The only thing making this a worthwhile occasion for me was the Princeton-educated guy, who was also in the group (yes, everyone had had to give their bona fides before we did the tour - a free luncheon really), who sidled up to me later and smiled knowingly and whispered, "Good for you!" He was a retired banker. (Of course.)

And the article presents the obvious conclusion, that keeping homes off the market is leading to higher prices than you’d see if they were put up for sale:

RealtyTrac, CoreLogic Confirm Housing Bear Thesis: 85-90% of REO Being Held Off Market, Meaning “Tight” Inventories Are Bogus

Friday, July 13, 2012

We’ve been mystified with the housing bull argument that things really are getting better. While realestate is always and ever local, and some markets may indeed be on the upswing, there are ample reasons to doubt the idea that an overall housing recovery is in. For instance, the recent FHFA inspector general report stated:Reader MBS Guy noted:

Further, general distress in the housing sector will likely continue to result in elevated REO inventories. For example, the Enterprises’ financial data indicate that, as of the end of 2011, more than 1.1 million mortgages held or guaranteed by the Enterprises were “seriously delinquent,” i.e., were 90 or more days past due. At that time, the volume of seriously delinquent mortgages was more than six times the size of the Enterprises’ REO inventories.

My rough calculation of their REO and delinquency numbers would indicate that they will have about 300,000 new REOs (acquisitions, in their parlance) per year for the next three years, assuming their isn’t a surge in new defaulters from their portfolio (ie – just using the loans currently seriously delinquent). They also report 179,000 properties currently in REO (end of 2011).

If they maintain their 2011 rate of REO dispositions at 353,000, the pipeline would be largely cleared in about 3 years. If they are able to increase the pace a bit, perhaps the inventory clears in 2-2.5 years.

Either way, it is very likely that about 1 million REO properties will be disposed of by the GSEs over the next 2-3 years. Over the last 3 years, they have disposed of about 833,216 REOs.

What will the impact on home prices be in the rate of REO disposition i(f) the next 3 years matches or exceeds the rate of disposition of the last 3 years? I’d expect that it will be pretty negative.Remember, that’s ONLY Fannie and Freddie mortgages. Recall that 1.1 million figure, serious delinquencies in their portfolios. Top housing analyst Laurie Goodman puts the total across themarket at 2.8 million.

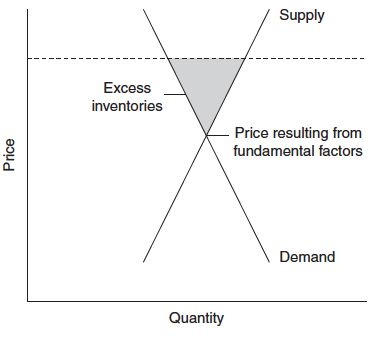

So why are we seeing so much housing cheerleading? One big “proof” is that housing inventories are supposedly shrinking. If you recall the classic supply/demand chart, if a price is higher than the market price, you expect to see big inventories somewhere. Conversely, if inventories are falling below a “normal” level (there are always some buffers in a system), that’s a sign of strengthening demand.

But we’ve seen so much evidence that the inventories that the commentators are looking at are misleading it isn’t funny. Banks were attenuating foreclosures even before the robosigning scandal broke. In the states with real housing distress, banks will take foreclosures up to the stage of actually taking title from the owner, and let it sit in limbo for a protracted period.

But in addition to delays in real estate being taken into REO, there is also evidence of banks simply not putting real estate owned by securitizations, the GSEs, or the banks themselves, on the market, thus keeping it out of visible inventories.

For instance, numerous NC readers report they see vacant homes, want to make an offer, and can’t find out who to contact to do so. That is a pretty strong sign that those homes are also not in official REO inventories.

And let’s consider the implications of that chart, again: if there ARE large inventories, that’s means supply is being constrained and the resulting “market” prices are above where they’d be based on fundamentals. So any price improvement is based not on improving conditions, but the manipulation of supply.

We finally have some official confirmation of our thesis. From AOL’s Real Estate blog, “‘Shadow REO’: As Many as 90% of Foreclosed Properties Held Off the Market, Estimates Suggest“:

As many as 90 percent of REOs are withheld from sale, according to estimates recently provided to AOL Real Estate by two analytics firms. It’s a testament to lenders’ fears that flooding the market with foreclosed homes could wreak havoc on their balance sheets and present a danger to the housing market as a whole.

Online foreclosure marketplace RealtyTrac recently found that just 15 percent of REOs in the Washington, D.C., area were for sale, a statistic that is representative of nationwide numbers, the company said.

Analytics firm CoreLogic provided an even lower estimate, suggesting that just 10 percent of all REOs in the country are listed by their owners, which include mortgage giants Fannie Mae and Freddie Mac as well as the Federal Housing Administration. As of April 2012, 390,000 repossessed homes sat in limbo, while about 39,000 were actually listed for sale, said Sam Khater, senior economist at CoreLogic.

Daren Blomquist, vice president of RealtyTrac, said that he was surprised by his company’s finding, especially since a similar analysis in 2009 found that banks were attempting to sell nearly twice as much of their REO inventory back then.

In fact, if lenders turn their REO release valve to full blast, the deluge of foreclosures cascading onto the market could plunge the country into a recession, said Thomas Martin, president of consumer advocacy group Americas Watchdog.

“If they let the dam essentially break, it could be a catastrophic disaster for the U.S. economy,” he said, predicting that some major banks would fail and home prices would nosedive by 20 percent.

That doomsday scenario has many industry professionals supporting lenders’ tactics of holding onto most of their REOs. Otherwise, they would be “causing the floor to fall out from underneath the entire market,” Faranda said. He added that banks don’t have the manpower to push the paperwork required to put all their foreclosures on the market.Of course, the discussion focuses on how much price manipulation is justified, as opposed to the real problem: we have had, and continue to have, far too many foreclosures and far too few mortgage modifications.

But the solution seems to be to zombify the housing market rather than make servicers change their ways.

No comments:

Post a Comment