I've just spent most of Christmas day listening to Live from Daryl's House. This rocks.

"Bring it back home. Come on down to myyyy house!"

Smokey!

Joe Walsh, Todd Rundgren!

Allen Stone?

Great sounds.

Which does not undermine the seriousness of this next Christmas message:

This Christmas, homeless data is changing in shocking ways: Fewer people on streets, but a record for homeless kids

The Rude Pundit levels the MSM killing fields:

The NRA has caused more cop shootings than a nonstop parade of protests.

Conservatives don't actually give a fuck about cops as people, despite their moaning over the deaths of Officers Liu and Ramos. What they like is the authority and control the cops represent, the police force as a means of oppressing dissent (and, let's be honest, a lot of cops get off on the authority and control, too).

If the right-wing did give a fuck, police would make a shit-ton more money, paid for by tax hikes, like Democratic Mayor Mitch Landrieu is attempting in New Orleans.

And maybe they'd not cut the pensions and benefits of retired cops like fake tough guy Chris Christie, who seeks to balance New Jersey's budget on the backs of the police and firefighters.

In October, a retired police officer called into a radio show to talk to Christie. After brushing off the cop's attempt to criticize him, Christie jowled, "You're a guy that retired at 58 years old, with a full pension and free medical benefits for life, and you're coming on the air to complain...Pay your fair share." If President Obama said that, Fox "news" would cause riots.

What is hurting cops more? Mayor de Blasio saying that asshole cops should stop being assholes? Or Gov. Christie telling cops that their pensions might not be there in full when they retire?

Tough telling the bad guys?

USA USA USA!!!

Not exactly the Christmas message on which we usually lean for the good me feelings.

The CIA & NYPD: Perilous Insubordination In Our Democracy

By on December 22, 2014

Lifted gently from the irrepressibly salient Ramona's Voices blog.

Thanks, girl!

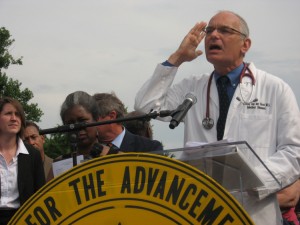

Who Am I? Guess the Progressive

Can you identify this person?

Occasional Planet’s “Who Am I” series features people who have made important contributions to liberal thought, progressive politics, human rights, enlightened education, environmental awareness, and “small-d” democratic principles–both in the US and internationally.

The abbreviated bios in our “Progressive Hall of Fame” only hint at the scope of our hall of famers’ struggles and accomplishments. We hope that curiosity will impel you find out more about these inspiring people, whose professional efforts and personal sacrifices deserve to be remembered — and emulated.

To see a gallery of the progressive role models previously featured on Occasional Planet, click here. Our current featured progressive role model is:

CHARLES VAN DER HORST

Physician, AIDS researcher, activist

Claims to Progressive Fame:

Participated in 2013 in the Moral Monday protests at the North Carolina state legislature building, where he was among 29 protesters who were arrested for protesting the state’s refusal to expand Medicaid under the Affordable Care Act.

Refuses to remain silent about the immorality of government denying healthcare insurance to 300,000 to 500,000 of North Carolina’s working poor.

Went to jail to demonstrate the reality that between 1,000 to 2,000 North Carolinians die unnecessarily each year because they lack the financial means to seek timely healthcare.

To hear Van Der Horst speak about Medicaid expansion and his involvement as an activist, click here.

I bought gas yesterday for $1.299/gallon in North Carolina.

Right.

Good times.

Brrrrrraaaaaaaahhhhhahahaha!

Oil Crash: Don’t Believe the Happy Clatter

By Pam Martens and Russ Martens

December 23, 2014

There is a mushrooming false narrative taking over the business airwaves: lower oil prices lead to lower prices at the pump which put more cash in consumers’ pockets which will lead to a more robust economy in the United States in 2015.Yes, there are certainly lower prices at the pump. Yes, that gives consumers more disposable income. But it will decidedly not lead to a more robust economy in the United States for very long.

This isn’t a little speed bump in oil prices. This is one of the most dramatic and rapid crashes in a key industrial commodity in history. Since June, the price of West Texas Intermediate (WTI), the domestic crude oil produced in the U.S., is down by 47 percent. The price of the internationally traded crude oil, Brent, is down by a similar figure.

If this price collapse were happening in just crude oil, it could be shrugged off as a supply glut problem attributable to growing shale production in the U.S. and over production among OPEC members. But other industrial commodities are in freefall as well. Iron ore prices are down 49 percent this year while copper has declined 15 percent. The price of natural gas is down 30 percent in just the past month, including a plunge of 9 percent just yesterday.

Data from the Bureau of Labor Statistics shows that a broad gauge of industrial commodity prices entered a gradual decline in June and then began to plunge in September. That chart looks suspiciously similar to the price action in industrial commodities in the same time period in 2008 – which signaled an early warning to the greatest economic collapse in the United States since the Great Depression. (See charts below.)

Industrial commodity prices are a leading indicator of things that are more than pesky details to economic stability. A robust manufacturing sector and robust consumer demand is simply not compatible with crashing industrial commodity prices.

Plunging industrial commodity prices are compatible with the sharp decline in the interest rate on the 10-year U.S. Treasury note and the fact that yields on similar maturity sovereign debt in Germany, Italy, Austria, Belgium, Finland, France and Ireland set all-time lows this month.

You are no doubt thinking by now that the U.S. stock market is also supposed to be a reliable barometer of economic vitality – looking out on the horizon by about six months.

Sorry. You’re confusing the stock market barometer of yesteryear with today’s cacophony coming from high frequency traders, artificial intelligence algorithms, co-located computers, dark pools, and over $1 trillion in corporations buying back their own stock.

It might be helpful to remember that the Dow Jones Industrial Average went from 12,000 to 13,000 between March and May of 2008 before entering a plunge that would take it to the 6500 range by March of 2009. (It should be noted, however, that frothy markets can become frothier than the current one before reality sets in.)

Federal Reserve Chair, Janet Yellen, has climbed out on a very precarious limb in this debate. Both the December 17, 2014 statement from the Federal Open Market Committee (FOMC) and Yellen in her press conference that day, characterized the collapse in energy prices as “transitory.” The FOMC statement read: “The Committee expects inflation to rise gradually toward 2 percent as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate.” Nothing about the charts below gives an impression of “transitory” conditions.

Not everyone at the Federal Reserve is part of the happy clatter crowd. On October 13, 2014, Chicago Fed President, Charles Evans, spoke before the annual conference of the National Council on Teacher Retirement in Indianapolis. Evans expressed skepticism that an economy can be robust with the tepid growth in wages happening in the United States. Evans stated:

“…it is hard to imagine a robust labor market without solid growth in wages. With productivity growth of around 1 to 2 percent and an inflation target of around 2 percent, we should be seeing wages and benefits rising at around a 3 to 4 percent rate.

But that is clearly not the case. Although some in-demand occupations may be experiencing stronger wage growth, overall compensation growth has been around 2 percent over the past six years. Taken altogether, these and other measures lead me to conclude that there remains significant underutilization of labor resources — and likely somewhat more slack than what is indicated by the unemployment rate alone.”

Producer Price Index — Industrial Commodities, July through November 2014 (Graph courtesy of the Federal Reserve Bank of St. Louis; data from Bureau of Labor Statistics)

Producer Price Index — Industrial Commodities, July through December 2008 (Graph courtesy of the Federal Reserve Bank of St. Louis; data from Bureau of Labor Statistics.)

No comments:

Post a Comment