We always get the full story from Chris Hedges.

Although so few people want to hear it.

The Most Brazen Corporate Power Grab in American History

Posted on Nov. 6, 2015

By Chris Hedges

The release Thursday of the 5,544-page text of the Trans-Pacific Partnership—a trade and investment agreement involving 12 countries comprising nearly 40 percent of global output — confirms what even its most apocalyptic critics feared.

“The TPP, along with the WTO [World Trade Organization] and NAFTA [North American Free Trade Agreement], is the most brazen corporate power grab in American history,” Ralph Nader told me when I reached him by phone in Washington, D.C. “It allows corporations to bypass our three branches of government to impose enforceable sanctions by secret tribunals. These tribunals can declare our labor, consumer and environmental protections [to be] unlawful, non-tariff barriers subject to fines for noncompliance. The TPP establishes a transnational, autocratic system of enforceable governance in defiance of our domestic laws.”

The TPP is part of a triad of trade agreements that includes the Transatlantic Trade and Investment Partnership (TTIP) and the Trade in Services Agreement (TiSA). TiSA, by calling for the privatization of all public services, is a mortal threat to the viability of the U.S. Postal Service, public education and other government-run enterprises and utilities; together these operations make up 80 percent of the U.S. economy. The TTIP and TiSA are still in the negotiation phase. They will follow on the heels of the TPP and are likely to go before Congress in 2017.

These three agreements solidify the creeping corporate coup d’état along with the final evisceration of national sovereignty. Citizens will be forced to give up control of their destiny and will be stripped of the ability to protect themselves from corporate predators, safeguard the ecosystem and find redress and justice in our now anemic and often dysfunctional democratic institutions. The agreements — filled with jargon, convoluted technical, trade and financial terms, legalese, fine print and obtuse phrasing — can be summed up in two words: corporate enslavement.

The TPP removes legislative authority from Congress and the White House on a range of issues. Judicial power is often surrendered to three-person trade tribunals in which only corporations are permitted to sue. Workers, environmental and advocacy groups and labor unions are blocked from seeking redress in the proposed tribunals. The rights of corporations become sacrosanct. The rights of citizens are abolished.

The Sierra Club issued a statement after the release of the TPP text saying that the “deal is rife with polluter giveaways that would undermine decades of environmental progress, threaten our climate, and fail to adequately protect wildlife because big polluters helped write the deal.”

If there is no sustained popular uprising to prevent the passage of the TPP in Congress this spring we will be shackled by corporate power. Wages will decline. Working conditions will deteriorate. Unemployment will rise. Our few remaining rights will be revoked. The assault on the ecosystem will be accelerated. Banks and global speculation will be beyond oversight or control. Food safety standards and regulations will be jettisoned. Public services ranging from Medicare and Medicaid to the post office and public education will be abolished or dramatically slashed and taken over by for-profit corporations.

Prices for basic commodities, including pharmaceuticals, will skyrocket. Social assistance programs will be drastically scaled back or terminated. And countries that have public health care systems, such as Canada and Australia, that are in the agreement will probably see their public health systems collapse under corporate assault. Corporations will be empowered to hold a wide variety of patents, including over plants and animals, turning basic necessities and the natural world into marketable products.

And, just to make sure corporations extract every pound of flesh, any public law interpreted by corporations as impeding projected profit, even a law designed to protect the environment or consumers, will be subject to challenge in an entity called the investor-state dispute settlement (ISDS) section. The ISDS, bolstered and expanded under the TPP, will see corporations paid massive sums in compensation from offending governments for impeding their “right” to further swell their bank accounts. Corporate profit effectively will replace the common good.

Given the bankruptcy of our political class — including amoral politicians such as Hillary Clinton, who is denouncing the TPP during the presidential campaign but whose unwavering service to corporate capitalism assures her fealty to her corporate backers — the trade agreement has a good chance of becoming law. And because the Obama administration won fast-track authority, a tactic designed by the Nixon administration to subvert democratic debate, President Obama will be able to sign the agreement before it goes to Congress.

The TPP, because of fast track, bypasses the normal legislative process of public discussion and consideration by congressional committees. The House and the Senate, which have to vote on the TPP bill within 90 days of when it is sent to Congress, are prohibited by the fast-track provision from adding floor amendments or holding more than 20 hours of floor debate. Congress cannot raise concerns about the effects of the TPP on the environment. It can only vote yes or no. It is powerless to modify or change one word.

There will be a mass mobilization Nov. 14 through 18 in Washington to begin the push to block the TPP. Rising up to stop the TPP is a far, far better investment of our time and energy than engaging in the empty political theater that passes for a presidential campaign.

“The TPP creates a web of corporate laws that will dominate the global economy,” attorney Kevin Zeese of the group Popular Resistance, which has mounted a long fight against the trade agreement, told me from Baltimore by telephone. “It is a global corporate coup d’état. Corporations will become more powerful than countries. Corporations will force democratic systems to serve their interests. Civil courts around the world will be replaced with corporate courts or so-called trade tribunals. This is a massive expansion that builds on the worst of NAFTA rather than what Barack Obama promised, which was to get rid of the worst aspects of NAFTA.”

The agreement is the product of six years of work by global capitalists from banks, insurance companies, Goldman Sachs, Monsanto and other corporations.

“It was written by them [the corporations], it is for them and it will serve them,” Zeese said of the TPP. “It will hurt domestic businesses and small businesses. The buy-American provisions will disappear. Local communities will not be allowed to build buy-local campaigns. The thrust of the agreement is the privatization and commodification of everything. The agreement has built within it a deep antipathy to state-supported or state-owned enterprises. It gives away what is left of our democracy to the World Trade Organization.”

![]()

The economist David Rosnick, in a report on the TPP by the Center for Economic and Policy Research (CEPR), estimated that under the trade agreement only the top 10 percent of U.S. workers would see their wages increase. Rosnick wrote that the real wages of middle-income U.S. workers (from the 35th percentile to the 80th percentile) would decline under the TPP. NAFTA, contributing to a decline in manufacturing jobs (now only 9 percent of the economy), has forced workers into lower-paying service jobs and resulted in a decline in real wages of between 12 and 17 percent. The TPP would only accelerate this process, Rosnick concluded.

“This is a continuation of the global race to the bottom,” Dr. Margaret Flowers, also from Popular Resistance and a candidate for the U.S. Senate, said from Baltimore in a telephone conversation with me. “Corporations are free to move to countries that have the lowest labor standards. This drives down high labor standards here. It means a decimation of industries and unions. It means an accelerated race to the bottom, which we must rise up to stop.”

“In Malaysia one-third of tech workers are essentially slaves,” Zeese said. “In Vietnam the minimum wage is 35 cents an hour. Once these countries are part of the trade agreement U.S. workers are put in a very difficult position.”

Fifty-one percent of working Americans now make less than $30,000 a year, a new study by the Social Security Administration reported. Forty percent are making less than $20,000 a year. The federal government considers a family of four living on an income of less than $24,250 to be in poverty.

“Half of American workers earn essentially the poverty level,” Zeese said. “This agreement only accelerates this trend. I don’t see how American workers are going to cope.”

The assault on the American workforce by NAFTA — which was established under the Clinton administration in 1994 and which at the time promised creation of 200,000 net jobs a year in the United States — has been devastating. NAFTA has led to a $181 billion trade deficit with Mexico and Canada and the loss of at least 1 million U.S. jobs, according to a report by Public Citizen. The flooding of the Mexican market with cheap corn by U.S. agro-businesses drove down the price of Mexican corn and saw 1 million to 3 million poor Mexican farmers go bankrupt and lose their small farms. Many of them crossed the border into the United States in a desperate effort to find work.

“Obama has misled the public throughout this process,” Dr. Flowers said. “He claimed that environmental groups were supportive of the agreement because it provided environmental protections, and this has now been proven false. He told us that it would create 650,000 jobs, and this has now been proven false. He calls this a 21st century trade agreement, but it actually rolls back progress made in Bush-era trade agreements. The most recent model of a 21st century trade agreement is the Korean free trade agreement. That was supposed to create 140,000 U.S. jobs. But what we saw within a couple years was a loss of about 70,000 jobs and a larger trade deficit with Korea. This agreement [the TPP] is sold to us with the same deceits that were used to sell us NAFTA and other trade agreements.”

The agreement, in essence, becomes global law. Any agreements over carbon emissions by countries made through the United Nations are effectively rendered null and void by the TPP.

“Trade agreements are binding,” Flowers said. “They supersede any of the nonbinding agreements made by the United Nations Climate Change Conference that might come out of Paris.”

There is more than enough evidence from past trade agreements to indicate where the TPP — often called “NAFTA on steroids” — will lead. It is part of the inexorable march by corporations to wrest from us the ability to use government to defend the public and to build social and political organizations that promote the common good. Our corporate masters seek to turn the natural world and human beings into malleable commodities that will be used and exploited until exhaustion or collapse. Trade agreements are the tools being used to achieve this subjugation. The only response left is open, sustained and defiant popular revolt.

Keep up with Chris Hedges’ latest columns, interviews, tour dates and more at www.truthdig.com/chris_hedges.

Thanks, Chris.

And now we know.

(And it's even worse than we think?)

I hope none of my readers thought that the seemingly-unending Boehner-replacement kabuki dance was for real.

Because the owners' boys are just switching places.

Again.

Although Boehner leaves the public sphere (view) for the comfy hedge fund venue soon.

And don't forget the reason why the banksters felt free to give themselves bonuses as the greatest losses ever suffered from the bad actions of those self-same banksters crashed the financial world for everyone else.

Business as Usual – Paul Ryan Pushes Through Multiple Wall Street Giveaways in the Highway Bill

Posted

It was always going to be a seamless transition from John Boehner to Paul Ryan. These men are cut from the exact same cloth, which is worshipping at the altar of crony capitalism. They talk a good game about about “free markets” and “entrepreneurship,” but at the end of the day, are both staunch defenders of statist, centrally planned economies, as long as the subsidies go to mega-corporations.

David Dayan, who’s excellent work I’ve covered many times here at "Liberty Blitzkrieg," just published an article at the "Fiscal Times" outlining the plethora of Wall Street giveaways recently added onto the “Highway Bill.” One of these relates to something I’ve covered previously, the 6% annual dividend paid by the Federal Reserve to its member banks. Here’s some background from a previous post, Banks Squirm as Congress Moves to Cut the 6% Dividend Paid to Them by the Federal Reserve:

Have you looked at your checking or money market bank statement lately from JPMorgan Chase or Citibank? How about the statement showing the interest you’re earning on your mortgage escrow account with the big banks? While the country suffers through the lingering effects of the Great Recession caused by the biggest Wall Street banks, the public typically receives less than 1 percent on their deposits at the big banks, while the government has legislated a permanent, risk-free 6 percent guarantee to the Wall Street banks for their capital on deposit at the Fed. Now that’s an entitlement program that needs to die!

This corporate welfare program gets even better: if the shares of stock were acquired prior to March 28, 1942, the 6 percent risk-free dividend is tax exempt and the bank doesn’t have to pay corporate taxes on it.

There had been a Senate proposal in the Highway Bill to reduce this payout to 1.5% for all banks with more than $1 billion in assets. Naturally, the Republicans in the House, led by Paul Ryan, killed it. Wall Street always gets it way in Congress. Always.

From the "Fiscal Times":

It seems bizarre that financial policy would get decided in a bill to repair roads and bridges and mass transit, but that’s the whole point of the Christmas tree strategy: If a bill is deemed “must pass,” then adding ornaments to it comprises a good strategy for getting things into law that otherwise might not receive a vote.

Ryan touted this process as a positive example of new leadership. In recent years, House bills written in secret sped to the floor without the ability for alterations. But on the highway bill, over 80 amendments got a vote on the House floor, out of hundreds offered.

The shortfall forced Republicans to search for extra revenue to fully fund the bill. The Senate hit on a great idea: cutting $16.3 billion from a 102-year-old risk-free giveaway to banks.

Member banks, in exchange for access to the Federal Reserve’s payment services and borrowing facilities, must purchase stock in the regional Fed banks. That stock cannot lose value or be sold — and it carries a 6 percent dividend. The stock operates like a membership fee, only it’s not a fee: The member banks get all of their money back within 17 years and then start earning profit on it. Most of the dividends are exempt from taxes. And nationally chartered banks have to join the Fed by law anyway, while all banks must conform to the rules of membership, so offering a dividend to give them an incentive to join the Fed — the original purpose of the scheme — has no relevance today.

Fed Chair Janet Yellen, the banking industry and its minions in Congress attacked this dividend cut, but it covered such a big chunk of the shortfall — in the Senate’s bill, it paid for one-third of it — that it appeared banks would lose their subsidy. But at the last minute, Republicans Randy Neugebauer of Texas and Bill Huizenga of Michigan devised a way to save it, by amending the bill to instead liquidate something called the Federal Reserve capital surplus account.

It’s also a massive budgetary gimmick. The Fed already remits earnings from its balance sheet to the Treasury Department annually. This liquidation — with the Fed selling off interest-bearing assets — would reduce future earnings, just like cashing out your savings account eliminates future interest gained. But because Fed remittances aren’t on budget, it appears like it raises money. A 2002 Government Accountability Office report explains that reducing the capital surplus account creates phantom revenue for budget accounting, but would “not produce new resources for the federal government as a whole.”

The financial industry’s main argument against the measures it didn’t like was that sources of funding unrelated to our roads shouldn’t be spent on the highway bill, but that’s exactly what Congress did with the Fed’s capital surplus account. I guess it’s okay as long as big banks benefit.

Mind you, the House didn’t touch the other revenue-raisers in the bill, including a preposterous provision to force the IRS to hire private debt collectors to go after back taxes, something that has lost money every time it’s been tried. Only two so-called “pay-fors” were replaced: the big bank subsidy, and a measure extending fees charged by Fannie Mae and Freddie Mac to guarantee mortgages. Banks hated that one as well, because they don’t want to pay out of their mortgage profits.

Just in case you haven’t figured it out yet, these RINOs are total frauds.

Let’s make it plain, then: The hard-right conservatives committed to fighting “crony capitalism” all bailed out the banks by preserving their profits.

And of course, the most crony item of all was also saved, naturally…

The bill also re-authorizes the Export-Import Bank, which facilitates corporate exports with foreign countries. Goldman Sachs, which has recently delved into co-owning commercial enterprises that benefit from Ex-Im funding, heavily lobbied for re-authorization.

Goldman, you know, the “Too Big to Jail and Fail” bank recently caught scamming profits from a plan to help preschool kids in Utah.

And that’s not all for Wall Street. While Republicans ultimately declined to pursue the most far-reaching deregulatory measures they had lined up for the bill, they did pass an amendment from House Financial Services Committee Chairman Jeb Hensarling. This amendment packaged 15 separate bills, many of which have already passed the House previously but might not have gotten through the Senate.

Hensarling describes these as “technical changes.” But as Americans for Financial Reform point out, some go much further. The “SBIC Advisers Relief Act” would pre-empt states from regulating companies that invest in and advise small businesses. It would also allow private equity firms to grow their balance sheets above established limits that trigger additional oversight. The “Improving Access to Capital for Emerging Growth Companies Act” would allow such companies to omit disclosure of their financial dealings to investors. It would also let big banks stop telling their customers about the sharing of their financial data with other companies, weakening privacy protections.

AFR’s biggest complaint is that the Christmas tree mentality will just go on, established by Speaker Ryan through this precedent.

It truly never ends. Of course, this whole thing was entirely predictable, if you did any research at all into who Paul Ryan really is. Here are a few reminders:

Paul Ryan Hires Lobbyist Who Pushed for Obamacare and the Trans-Pacific Partnership as His Chief of Staff

Paul Ryan Channels Pelosi on the TPP – You Have to Pass Obamatrade to See What’s in Obamatrade

In Liberty,

Michael Krieger

Remember the ALEC takeover of many state governments? (North Carolina springs to mind.)

Ford Motor Company Revealed As Funder of Climate Denial Group ALEC

God’s Work – How Goldman Sachs Scammed a Utah Program Meant to Help Preschool Children

Professor Craig has put the whole schmear together for us so simply that it's almost strange that no one else has.

Almost.

The Re-Enserfment of Western Peoples

November 9, 2015

Paul Craig Roberts

The re-enserfment of Western peoples is taking place on several levels. One about which I have been writing for more than a decade comes from the offshoring of jobs. Americans, for example, have a shrinking participation in the production of the goods and services that are marketed to them.

On another level we are experiencing the financialization of the Western economy about which Michael Hudson is the leading expert (Killing The Host). Financialization is the process of removing any public presence in the economy and converting the economic surplus into interest payments to the financial sector.

These two developments deprive people of economic prospects. A third development deprives them of political rights. The Trans-Pacific and Trans-Atlantic Partnerships eliminate political sovereignty and turn governance over to global corporations.

These so called “trade partnerships” have nothing to do with trade. These agreements negotiated in secrecy grant immunity to corporations from the laws of the countries in which they do business. This is achieved by declaring any interference by existing and prospective laws and regulations on corporate profits as restraints on trade for which corporations can sue and fine “sovereign” governments. For example, the ban in France and other counries on GMO products would be negated by the Trans-Atlantic Partnership. Democracy is simply replaced by corporate rule.

I have been meaning to write about this at length. However, others, such as Chris Hedges, are doing a good job of explaining the power grab that eliminates representative government.

http://www.opednews.com/articles/1/The-Most-Brazen-Corporate-by-Chris-Hedges-American-Hypocrisy_Americans-For-Prosperity_Corporate-Citizenship_Corporate-Crime-151107-882.html

The corporations are buying power cheaply. They bought the entire US House of Representatives for just under $200 million. This is what the corporations paid Congress to go along with “Fast Track,” which permits the corporations’ agent, the US Trade Representative, to negotiate in secret without congressional input or oversight. http://www.opednews.com/articles/Almost-200-Million-Donate-by-Paola-Casale-Banking_Congress_Control_Corporations-150620-523.html

In other words, a US corporate agent deals with corporate agents in the countries that will comprise the “partnership,” and this handful of well-bribed people draw up an agreement that supplants law with the interests of corporations. No one negotiating the partnership represents the peoples’ or public’s interests. The governments of the partnership countries get to vote the deal up or down, and they will be well paid to vote for the agreement.

Once these partnerships are in effect, government itself is privatized. There is no longer any point in legislatures, presidents, prime ministers, judges. Corporate tribunals decide law and court rulings.

It is likely that these “partnerships” will have unintended consequences. For example, Russia and China are not part of the arrangements, and neither are Iran, Brazil, India, and South Africa, although seperately the Indian government appears to have been purchased by American agribusiness and is in the process of destroying its self-sufficient food production system. These countries will be the repositories for national sovereignty and public control while freedom and democracy are extinguished in the West and the West’s Asian vassals.

Violent revolution throughout the West and the complete elimination of the One Percent is another possible outcome. Once, for example, the French people discover that they have lost all control over their diet to Monsanto and American agribusiness, the members of the French government that delivered France into dietary bondage to toxic foods are likely to be killed in the streets.

Events of this sort are possible throughout the West as peoples discover that they have lost all control over every aspect of their lives and that their only choice is revolution or death.

I keep remembering, for some reason, that if we elected Ben Carson, we'd really have a truly black president.

Ten points go to the lucky audience member who can remember the source of this fine quote first.

The Carson Grift Goes South

November 7, 2015

Scott pointed out a few days ago that the Carson presidential campaign is pretty much just another Armstrong Williams-managed griftathon, although I think there are legitimate questions about the extent to which Carson himself is one of the marks.

Anyway, this particular carnival is probably about to be moving on down the road.

Public banking? Who talks about that?

Monetary reform? Isn't that what got us here?

For a refreshing take on these topics:

Instant Millionaire Status Per US Household: Top 3 Benefits of Monetary Reform, Public Banking

October 30, 2015

by Carl Herman

The top three benefits each of monetary reform and public banking total ~$1,000,000 for the average American household, and would be received nearly-instantly.

Please read the above sentence a second time, then verify the following factual claims to confirm its objective accuracy.

Monetary reform is the creation of debt-free money by government for the direct payment of public goods and services. Creating money as a positive number is an obvious move from our existing Robber Baron-era system of only creating debt owed to privately-owned banks (a negative number) as what we use for money.

Our Orwellian “non-monetary supply” of adding negative numbers forever causes today’s tragic-comic increasing and unpayable total debt. You learned these mechanics of positive and negative numbers in middle school, and already have the education and life experience to conclude with Emperor’s New Clothes absolute certainty that accelerating total debt is the opposite of having money. As a National Board Certified and Advanced Placement Macroeconomics teacher, I affirm this is also exactly what is taught to all economics students.

The public benefits of reversing this creature of Robber Barons are game-changing and nearly-instant. We the People must demand these, as .01% oligarchs have no safe way to do so without admission of literal criminal fraud by claiming that debt is its opposite of money.

The top 3 game-changing benefits of monetary reform:

- We pay the national debt in proportion to removing private banks’ ability to create what we use for money as debt in order to prevent inflation. We retire national debt forever.

- We fully fund infrastructure that returns more economic output than investment cost for triple upgrades: the best infrastructure we can imagine, up to full-employment, and lower overall costs.

- We stop the ongoing Robber Barons who McKinsey’s Chief Economist documents having ~$30 TRILLION in tax havens, and the Fed finding the US top seven banks creating shell companies to hide $10 trillion.

This amount is about 30 times needed to end all global poverty, which has killed more people since 1995 than all wars and violence in all human history. Public banking creates at-cost and in-house credit to pay for public goods and services without the expense and for-profit interest of selling debt-securities. North Dakota has a public bank for at-cost credit that results in it being the only state with annual increasing surpluses rather than deficits. Top 3 game-changing benefits of public banking:

1. a state-owned bank could abundantly fund all state programs and eliminate all taxes with just a 5% mortgage and credit card.

2. a state-owned bank could create in-house and at-cost credit to fund infrastructure. This cuts nominal costs in half because, as you know, selling debt securities typically doubles the cost. For example, where I live we’re still dismantling the old Bay Bridge in NoCal from the upgrade that cost $6 billion, but the debt-service costs will add another $6 billion when it’s all paid.

3. CAFRs (Comprehensive Annual Financial Reports) stash “rainy day” funds no longer required with a credit line from a public bank. In addition, the so-called “retirement funds” currently deliver net returns of just a few percent on good years, and negative returns on bad years (here, here).

California’s ~14,000 various government entities’ CAFRs have a sampled-data total estimate of $8 trillion in surplus taxpayer assets ($650,000 non-disclosed assets per household, among California’s ~12.5 million households).

$1,000,000 of benefits per US household:

Please understand that I represent likely hundreds of thousands of professionals making factual claims with objective evidence anyone with a high school-level of education can verify.

- Thomas Edison, Henry Ford, and Thomas Jefferson,

- President Andrew Jackson, famous inventor Peter Cooper,

- New York City Mayor John Hylan, two House of Representatives Banking Committee Chairs,

- Benjamin Franklin, William Jennings Bryan,

- Charles Lindbergh Sr., 86% of Great Depression economists,

The Emperor’s New Clothes obvious pathway out of these mechanics of our “debt system” is to start creating debt-free money (a positive number) for the direct payment of public goods and services, and create public credit for at-cost loans (a negative number). I have three academic papers to walk any reader through these facts; an assignment for high school economics students, one for Advanced Placement Macroeconomics students, and a paper for the Claremont Colleges’ recent academic conference:

Teaching critical thinking to high school students: Economics research/presentation

Debt-damned economics: either learn monetary reform, or kiss your assets goodbye

Seizing an alternative: Bankster looting: fundamental fraud that “debt” is “money”

4-minute video:

Ready to rise from your economic slavery?

Endnotes:

1) Of $60 trillion total debt, a conservative current interest cost of 5% is $3 trillion every year. Two trillion dollars of savings if the profits are transferred to the American public rather than to the banking industry is probably low. St. Louis Federal Reserve Bank: https://research.stlouisfed.org/fred2/series/TCMDO

2) The US GDP is ~$17 trillion. Three percent growth is moderately conservative.

3) Of the US Federal government’s ~$4 trillion annual budget, about $1.7 trillion is received from income tax.

4) Tax Foundation. Hodge, S, Moody, J, Warcholik, W. The Rising Cost of Complying with the Federal Income Tax. Jan. 10, 2006: http://www.taxfoundation.org/research/show/1281.html

(Carl Herman is a National Board Certified Teacher of US Government, Economics, and History; also credentialed in Mathematics. He worked with both US political parties over 18 years and two UN Summits with the citizen’s lobby, RESULTS, for US domestic and foreign policy to end poverty. He can be reached at Carl_Herman@post.harvard.edu)

Friends, don't read this next article.

It's far too depressing.

And it is Monday.

Behind October’s Sucker’s Rally – The Economic Trends Continued To Head South

by The Burning Platform

October 28, 2015

On October 2 the BLS reported absolutely atrocious employment data, with virtually no job growth other than the phantom jobs added by the fantastically wrong Birth/Death adjustment for all those new businesses springing up around the country. The MSM couldn’t even spin it in a positive manner, as the previous two months of lies were adjusted significantly downward.

What a shocker. At the beginning of that day the Dow stood at 16,250 and had been in a downward trend for a couple months as the global economy has been clearly weakening. The immediate rational reaction to the horrible news was a 250 point plunge down to the 16,000 level. But by the end of the day the market had finished up over 200 points, as this terrible news was immediately interpreted as good news for the market, because the Federal Reserve will never ever increase interest rates again.

Over the next three weeks, the economic data has continued to deteriorate, corporate earnings have been crashing, and both Europe and China are experiencing continuing and deepening economic declines. The big swinging dicks on Wall Street have programmed their HFT computers to buy, buy, buy. The worse the data, the bigger the gains. The market has soared by 1,600 points since the low on October 2. A 10% surge based upon lousy economic info, as the economy is either in recession or headed into recession, is irrational, ridiculous, and warped, just like our financial system. This is what happens when crony capitalism takes root like a foul weed and is bankrolled by a central bank that cares only for Wall Street, while throwing Main Street under the bus.

The employment situation continues to deteriorate on a daily basis as Challenger, Grey & Christmas has reported layoff announcements by major corporations in 2015 that already exceed the total announcements in 2014. This is the reality versus the BLS 5.1% unemployment rate fantasy. Retail sales, which make up two thirds of the economy, are putrid and confirm the dreadful employment market. Corporate profits among S&P 500 companies have fallen for two straight quarters and are picking up steam in a negative direction, as accounting shenanigans cannot disguise falling revenue forever. Earnings per share estimates for future quarters fall on a daily basis.

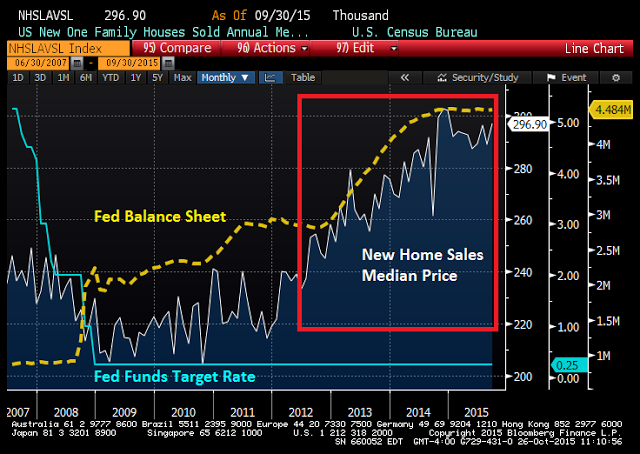

Every manufacturing and services survey flash recession warning. Despite propaganda from the NAR, government and the MSM, the housing market is dead in the water. Major home builders continue to report declining orders as new home sales are plummeting and existing home sales, without NAR adjustments, show a negative trend. But prices continue to rise as that has been the Fed’s purpose all along – to repair Wall Street bank balance sheets at any cost. Sacrificing the well being of tens of millions of senior citizens and millennials has been well worth it for Ben ($300,000 per Wall Street bank speaking engagement) and Janet, as the million-dollar banker bonuses have done wonders for high-end NYC penthouses and beachfront estates in the Hamptons.

The awful U.S. economic data pales in comparison to the absolute implosion occurring in China, as they desperately falsify economic growth data, threaten to prosecute stock sellers, censor truth tellers, bail out failing government entities, and manipulate their currency, to fend off impending disaster. Europe wallows in an ongoing depression as youth unemployment in most EU countries ranges between 20% and 50%. A bankrupt union of socialist states, dependent solely on central bankers issuing more debt to pay off old debt, have signed their own death warrant by allowing themselves to be overrun by hordes of Muslim refugees.

As John Hussman explains, the global economic situation has gotten so bad, central bankers have again come to the rescue by promising to prop stock markets up like they’ve been doing for the last six years.

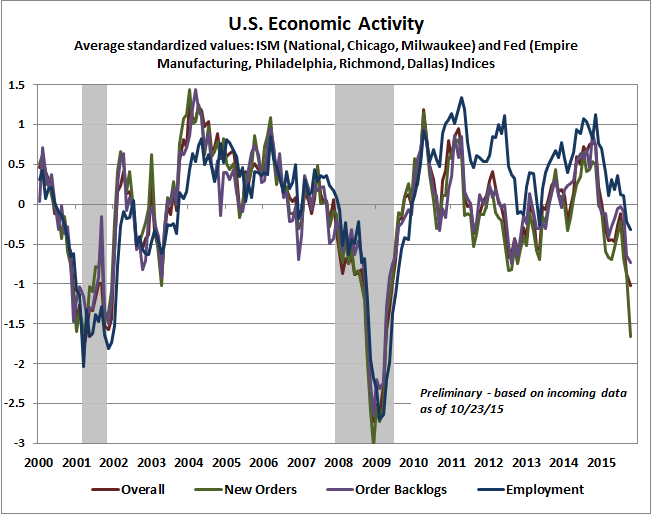

The market rebound of recent weeks has essentially been grounded in exuberance that the global economy is deteriorating so quickly that central banks will insist on accelerating their monetary interventions. While both corporate earnings and revenues are now in retreat, we also see enthusiasm about the remaining economic activity being captured by a handful of winner-take-all companies. Those two dynamics largely summarize the tone of the market here.U.S. economic data unequivocally indicates a recessionary environment on par with 2001 and 2008. Those periods did wonders for the wealth of stock investors, if you recall.

The following chart updates our standard economic review of regional and national Fed and purchasing managers’ surveys. The October Philadelphia Fed report was particularly weak on the new orders front, which is complicated by the fact that it’s also one of the more reliable surveys as an indication of broad economic activity. The chart below reflects available data through Friday.

The Pavlovian dog response of Wall Street traders to any hint of monetary easing or continued ease is as predictable as a monthly billion dollar fine being paid by an upstanding Wall Street financial institution. Obscene valuations, plunging corporate profits, and a low volume extremely narrow advance are not the ingredients of a new bull market. They are the ingredients of a dead cat bounce.

The underlying thesis, of course, is that monetary easing — regardless of its fruitless effects on the real economy — is a reliable signal that the financial markets are open for speculation. Valuations are the central driver of long-term investment returns, while market returns over shorter portions of the market cycle are primarily driven by the preference of investors to seek or avoid risk. At present, valuations remain obscene and market internals remain unfavorable. Credit spreads remain wide, and despite last week’s market advance, the percentage of individual stocks above their own respective 200-day moving average hardly budged, increasing only from 37% to just over 38%. Our broader measures of market internals remain unfavorable here as well.The pessimism overriding the markets from August through October was warranted, based on reality, facts and historically accurate valuation methods. The 1,600 point reversal has been based solely on hope and faith in central bankers who have failed miserably in spurring economic recovery with their monetary machinations. With valuations at nose bleed levels, rising P/E ratios due to declining earnings, record margin debt, and overly optimistic bulls, years of gains are poised to evaporate.

It’s essential to keep in mind that the equity market moves in cycles between extreme optimism, rich valuations, and poor prospective returns at market peaks, to extreme pessimism, favorable valuations, and high prospective returns at market lows. Even a run-of-the-mill bear market decline typically wipes out more than half the gain of the preceding bull market. Based on our current methods of classifying market return/risk profiles, the most severe market losses across history are captured by observable conditions that have emerged only about 9% of the time — a subset that that includes the present.The coming violent devastating crash, which will not be avoided through further central banker intervention, has been perpetuated, financed and encouraged by the Federal Reserve. They have trained the Wall Street Pavlovian dogs to salivate at the ringing of the QE/ZIRP bell. They’ve managed to delay the day of reckoning, but will not permanently fend off reality. Booms fueled by easy money, ALWAYS go bust.

The dogmatists running global central banks have encouraged investors to believe that volatility and downside risk have been, and can sustainably be, removed from the financial markets. No — by encouraging the illusion that normal cyclical fluctuations have been eliminated from the dynamics of the markets and the economy, the result has been far more risk taking, far heavier issuance of low-quality and covenant-lite debt, far more yield-seeking misallocation of capital, and far more extreme equity valuation in this cycle than would have been possible otherwise. The consequence will be far more violent market behavior over the completion of the cycle than investors would have faced otherwise.We’ve seen it all before. Two epic stock market collapses within the last fifteen years have been long forgotten by the Wall Street lemmings who ignore the fact the Fed eased during both market collapses. The fact the Fed has absolutely no ability to ease further as the economy deteriorates doesn’t seem to bother the perpetual bulls. Their level of historical ignorance is only matched by their hubris and arrogance.

The declines and recoveries we’ve seen over the past year are nothing that we did not also see during the extended 2000 and 2007 top formations. Once persistently overvalued, overbought, overbullish conditions were followed by deteriorating earnings growth and a breakdown in market internals, the goal wasn’t to speculate on rebounds, but only to limit the amount of frustration one had to endure during the top formation — in anticipation of the more severe market losses that followed.Denial and putting trust in Ivy League educated academics who are terminally wrong in their predictions, policies, and solutions is not a logical plan. It’s a recipe for disaster and another 50% haircut.

Based on the most historically reliable valuation measures, the S&P 500 would have to lose literally half of its value for prospective returns to rise to that level. A 50% market loss isn’t a worst-case scenario. Given current valuations, it’s the standard, run-of-the-mill outcome that investors should expect over the completion of this cycle.As John Hussman points out, we are about to be transported back to the wonderful days of 1929. Time is growing short as the grains of sand in the hourglass run out.

Investors are now facing the second most extreme episode of equity market overvaluation in U.S. history (current valuations on similar measures already exceed those of 1929). The belief that zero interest rates offer no alternative but to accept risk in stocks is valid only if one believes that stocks cannot experience profoundly negative returns. We know precisely how similar valuation extremes have worked out for investors over the completion of the market cycle, and those outcomes have never been deferred indefinitely. The only question at present is how many grains are left in the hourglass.

Source: The Worse Things Get For You, The Better They Get For Wall Street – The Burning Platform

October 30, 2015

How to Tell Good Guys from Bad Guys

JOHN STEINBECK:

Television has crept upon us so gradually in America that we have not yet become aware of the extent of its impact for good or bad. I myself do not look at it very often except for its coverage of sporting events, news, and politics. Indeed, I get most of my impressions of the medium from my young sons. Whether for good or bad, television has taken the place of the sugartit, soothing syrups, and the mild narcotics parents in other days used to reduce their children to semi-consciousness and consequently to semi-noisiness. In the past, a harassed parent would say, "Go sit in a chair!" or "Go outside and play!" or "If you don't stop that noise, I'm going to beat your dear little brains out!" The present-day parent suggests, "Why don't you go look at television?" From that moment the screams, shouts, revolver shots, and crashes of motor accidents come from the loudspeaker, not from the child. For some reason, this is presumed to be more relaxing to the parent. The effect on the child has yet to be determined. I have observed the physical symptoms of television-looking on children as well as on adults. The mouth grows slack and the lips hang open; the eyes take on a hypnotized or doped look; the nose runs rather more than usual; the backbone turns to water and the fingers slowly and methodically pick the designs out of brocade furniture. Such is the appearance of semi-consciousness that one wonders how much of the "message" of television is getting through to the brain. This wonder is further strengthened by the fact that a television-looker will look at anything at all and for hours. Recently I came into a room to find my eight-year-old son Catbird sprawled in a chair, idiot slackness on his face, with the doped eyes of an opium smoker. On the television screen stood a young woman of mammary distinction with ice-cream hair listening to a man in thick glasses and a doctor's smock.

Federal Government Rejects 'Do Not Track' Petition

The Federal Communications Commission (FCC) tossed out a consumer-led petition Friday that would have prevented websites and companies such as Google and Facebook from tracking users on request.

The advocacy group Consumer Watchdog submitted a “Do Not Track” petition to the FCC in June, requesting the regulatory agency to begin the rule-making process to enforce rules that would require online content and service providers such as Pandora, Google, Facebook, and Netflix to honor consumer privacy requests.

Consumers can now enact “do not track” requests in their browsers as a way to keep third-parties — including advertisers and social media companies — from monitoring their online behavior. But edge providers (companies that dish out internet-deployed content, apps, services, and devices) aren’t required to honor, and often ignore, those requests based on current regulations.

How Does Your State Rank for Integrity?

The 2015 State Integrity Investigation finds it doesn't look good

No comments:

Post a Comment