Where the Tech Jobs AreYou'll be surprised.

Bet on it.

November 6, 2015

Another Phony Payroll Jobs Number

Paul Craig Roberts

The Bureau of Labor Statistics announced today that the US economy created 271,000 jobs in October, a number substantially in excess of the expected 175,000 to 190,000 jobs. The unexpected job gain has dropped the unemployment rate to 5 percent. These two numbers will be the focus of the financial media presstitutes.

What is wrong with these numbers? Just about everything. First of all, 145,000 of the jobs, or 54%, are jobs arbitrarily added to the number by the birth-death model. The birth-death model provides an estimate of the net amount of unreported jobs lost to business closings and the unreported jobs created by new business openings. The model is based on a normally functioning economy unlike the one of the past seven years and thus overestimates the number of jobs from new business and underestimates the losses from closures. If we eliminate the birth-death model’s contribution, new jobs were 126,000.

Next, consider who got the 271,000 reported jobs. According to the Bureau of Labor Statistics, all of the new jobs plus some — 378,000 — went to those 55 years of age and older. However, males in the prime working age, 25 to 54 years of age, lost 119,000 jobs. What seems to have happened is that full time jobs were replaced with part-time jobs for retirees. Multiple job holders increased by 109,000 in October, an indication that people who lost full-time jobs had to take two or more part-time jobs in order to make ends meet.

Now assume the 271,000 reported jobs in October is the real number, and not 126,000 or less, where are those jobs? According to the BLS not a single one is in manufacturing. The jobs are in personal services, mainly lowly-paid jobs such as retail clerks, ambulatory health care service jobs, temporary help, and waitresses and bartenders.

For example, the BLS reports 44,000 new retail trade jobs, a questionable number in light of sluggish real retail sales. Possibly what is happening is that stores are turning a smaller number of full-time jobs into a larger number of part-time jobs in order to avoid benefit costs associated with full time workers.

The new reported jobs are essentially Third-World type of jobs that do not produce sufficient income to form a household and do not produce exportable goods and services to help to bring down the large US trade deficit resulting from jobs offshoring.

The problem with the 5% unemployment rate is that it does not include any discoraged workers. When discouraged workers — those who have ceased looking for a job because there are no jobs to be found — are included, the unemployment rate is about 23%.

Another problem with the 5% number is that it suggests full employment. Yet the labor force participation rate remains at a low point. Normally during a real economic recovery, people enter the labor force and the participation rate rises.

The bullion banks acting as agents of the Federal Reserve used the phony jobs number to launch another attack on gold and silver bullion, dumping uncovered shorts into the futures market. The strong jobs number provides cover for the naked shorts, because it implies an interest-rate hike and movement out of bullion into interest bearing assets.

If the US economy were actually in economic recovery, would half of the 25-year-old population be living with parents? The real job situation is so poor that young people are unable to form households. See: http://www.paulcraigroberts.org/2015/10/29/us-on-road-to-third-world-paul-craig-roberts/

My buddy, Driftglass, provides the historical insight so needed at this time of clown car candidates for the presidency and neolib nonsense glibly prevailing as all our social programs are eviscerated by slick deals in line with Grover Norquist's (co-founder of the Islamic Free Market Institute*) dictate to "get government so small you could drown it in a bathtub."

I shouldn't use so many of others' words, but as my readers have informed me that they hate to click on links due to fear of viruses, I do.

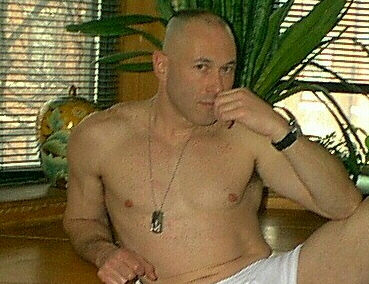

Where Have You Gone, Hotmilitarystud.com?

A nation turns its lonely eyes to you.

Because you are delightful and sane people with many better things to do, you definitely missed yesterday's edition of MSNBC's the daily three-hour Wingnut Propaganda Panderfest called "Morning Joe". The specific segment I am thinking about was after Chris Christie's 30-minute, on-air hot oil massage but before Squint and the Meat Puppet began their esophagus-limbering exercises in preparation for the on-air fellating of both Koch Brothers this morning.

The segment in which Joe Scarborough used some considerable fraction of his three-hours of MSNBC air-time to bitch about how there ain't no damn real Conservative in the teevee business and how awesome it would be if the Party of Lincoln, LLC, would get rid of the goddamn Berkeley twinkle-toe Commies who have been ruining the "debates" with their questions about math and "stuff you have done in the past"...

...and replace them with some real goddamn Conservatives who would ask real goddamn Conservative-type questions:

Which brings us around to the strange tale of Jeff Gannon (h/t alert friend-of-the-blog Kevin Holsinger for the reminder.) Or James Guckert. Or Johnny Gosch. You remember. That professional gay male prostitute who also somehow became part of the regular rotation of "legitimate journalists" in the Bush Administration press corps whose job it was to toss in "real" goddamn Conservative-type questions whenever Dubya or Scotty Dog McClellan started to drown in their own blood-soaked bullshit:

The fact that Jeff Gannon - a gay male hooker using a fake name - was allowed to build a little bird house for himself in the Bush White House press room should-have-but-didn't trigger half-a-dozen Congressional investigations should have been enough for any fair-minded person to kill the "Both Sides" lie once and for all. And the fact that the same Beltway media which was never happier than when it could wallow endlessly in a shit-pile of imaginary Clinton scandals refused to so much as touch this actual scandal sitting ten feet away with a barge pole -

- should have been enough for any fair-minded person to kill the "Librul Media" lie once and for all.

But we do not live in world run by or for fair-minded people. We live in a world where an obvious liar and clown like Joe Scarborough can be paid $77,000 a week to lie and clown three-hours a day, five days a week on your "Librul Media." We live in a world where the lunatics and demagogues running under the banner of the Party of Lincoln Scarborough can dictate the terms and conditions under which they will deign to answer questions about why they deserve to be president. We live in a world where genuine scandals like the Adventures of Jeff Gannon are bulldozed down the Memory Hole, while repeatedly debunked claptrap like Benghaaaazi rolls on like the mighty Mississippi.

In other words, the Party of Lincoln, LLC, has finally caught up with ol' "Aggressive Verbal Dominant Top" Jeffy.

So come home, Jeff Gannon. Or James Guckert. Or Johnny Gosch. Or whatever pseudonym you're renting yourself out under these days.

All is forgiven.

Speaking of the "Forgetting Nation" . . .

By Pam Martens and Russ Martens

November 3, 2015

Michael Hartnett, Chief Investment Strategist, Bank of America

It’s not every week that the regulator of the biggest banks in the U.S. and one of those biggest banks are both warning of growing financial risks.

On Sunday, Bank of America – the parent of Merrill Lynch and its more than 15,000 financial advisors – released a report calling the outlook for markets next year “perilous” and warning that “markets have not priced in quantitative failure.” The report came from Michael Hartnett, Bank of America’s Chief Investment Strategist and his team._ _ _ _ _ _ _

Yesterday, Thomas Curry, head of the Office of the Comptroller of the Currency (OCC) which regulates all national banks in the U.S., gave his second speech in a week and a half, using both occasions to warn of increasing credit risks at the biggest banks.

Curry spoke yesterday at the Risk Management Association’s annual conference in Boston. Curry dropped a significant bombshell on the audience, stating:

“Just over the last two years, the key ratio of the loan loss allowance to total loans dipped by more than 40 percent. Although banks have argued, with some justice – and please note the qualification – that improvements in loan quality justified those reserve releases, drawdowns of that magnitude are clearly disproportionate…”

On October 21, Curry told an audience at an Exchequer Club luncheon in Washington, D.C. that “we are clearly reaching the point in the cycle where credit risk is moving to the forefront.” Curry said potentially problematic areas include leveraged loans, home equity lines of credit, subprime auto loans, and commercial real estate.

The first obvious thought that arises is that the big banks may be padding their profit picture by under-reserving for loan losses. The second thought that arises is why their regulator is allowing them to do that when he is simultaneously conceding that credit risk is accelerating. The final thought is that Curry may hail from the same school of cognizant capture as Bill Dudley, President of the New York Fed, believing that jawboning will whip the serially malfeasant banks into shape. That’s the fantasy-land view that played a significant role in the 2007-2009 financial crash, culminating in the greatest economic implosion since the Great Depression.

According to an article at "Bloomberg Business" yesterday, Bank of America’s Michael Hartnett is calling attention to how much central bank policies of zero rates and quantitative easing, which globally have injected $12.4 trillion of liquidity into markets, have done for Wall Street while shortchanging average Americans. If that sounds like a nuanced rendition of the Occupy Wall Street message of “Banks got bailed out, we got sold out,” well, uh, it is.

"Bloomberg" quotes Hartnett as follows:

“Zero rates and asset purchases of central banks have, thus far, proved much more favorable to Wall Street, capitalists, shadow banks, ‘unicorns,’ and so on than it has for Main Street, workers, savers, banks and the jobs market.”

"Bloomberg" notes further from the report that “An investment of $100 in a portfolio of stocks and bonds since the Federal Reserve began quantitative easing would now be worth $205. Over the same time, a wage of $100 has risen to just $114.”

This raises the question as to whether those corporate stocks and bonds are dramatically inflated in value. It is, after all, the wage earner who needs the disposable income to buy the goods and services of those corporations issuing the stocks and bonds. With a slowdown in two of the major export markets of the U.S., Canada and China, the domestic wage earner in the U.S. becomes even more important.

Last month, CNBC, the cable business channel, highlighted another report from Hartnett. In that report, Hartnett wrote:

“If the secular reality of deflation and inequality is intensified by recession and rising unemployment, investors should expect a massive policy shift in 2016. Seven years after the West went ‘all-in’ on QE and ZIRP [Zero Interest Rate Policy], the U.S./Japan/Europe would shift toward fiscal stimulus via government spending on infrastructure or more aggressive income redistribution.”

There is no question that deflation is gripping much of the globe. According to "Bloomberg" data, the average yield on sovereign debt in Europe due within five years just clocked in at a minus 0.025 percent, the lowest on record.

The view that the U.S. might have to throw in the towel on central bank monetary policy riding to the rescue of the economy in 2016 stems from two realities. First, the U.S. central bank, the Federal Reserve, has no bullets left in its gun. It can’t cut interest rates further because it’s already at the zero interest rate bound range. Secondly, its balance sheet is already at an unprecedented $4.485 trillion as a result of past quantitative easing programs.

Then there is the fact that a populist fervor is engulfing the race to the White House – suggesting that those who don’t get on board rebalancing the interests of the country to help Main Street and away from the Wall Street-centric Fed will be joining the ranks of the unemployed.

* Norquist traveled to several war zones to help support anti-Soviet guerrilla armies in the second half of the 1980s. He worked with a support network for Oliver North's efforts with the Nicaraguan Contras and other insurgencies, in addition to promoting U.S. support for groups including Mozambique's RENAMO and Jonas Savimbi's UNITA in Angola[13] and helping to organize anti-Soviet forces in Laos. In 1985, he went to a conference in South Africa sponsored by South African businesses called the "Youth for Freedom Conference", which sought to bring American and South African conservatives together to end the anti-apartheid movement.[17] Norquist represented the France-Albert Rene government of The Seychelles as a lobbyist from 1995 until 1999. Norquist's efforts were the subject of Tucker Carlson's 1997 article in The New Republic, "What I sold at the revolution." [18][19]_ _ _ _ _ _ _

Ben Bernanke Is Still Keeping the Secrets of the Crash of 2007-2009

Hmmm.

Did I mention moving to Venus yet?

And who should be?

No comments:

Post a Comment