(If you can throw a few coins at this site's maintenance budget, it will be hugely appreciated. See the sign below for further enlightenment.)

The New York Times Endorses Hillary Clinton with a Banner Ad from Citigroup

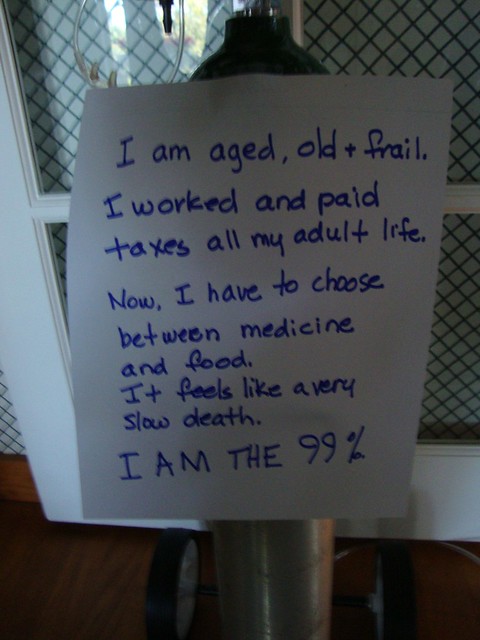

This One Photo Captures Why Americans Can’t Win Against Wall Street

U.S. Senate Holds a Critical Hearing on the Stock Market on March 3, 2016 and 73 Percent of the Senators on the Subcommittee Are a No-Show

New York Times Rethinks Hillary Clinton for President

Clinton Foundation Donors Got Weapons Deals From Hillary Clinton's State Department

Hillary and Bill: Their Rugged Journey from Paupers to One-Percenters in 365 Days (2014)

In an interview with ABC’s Diane Sawyer on June 9, Hillary Clinton said that she and former President Bill Clinton were “dead broke” when they left the White House in January 2001. The remark was made in this context by the former first lady: “We came out of the White House not only dead broke, but in debt. We had no money when we got there, and we struggled to, you know, piece together the resources for mortgages, for houses, for Chelsea’s education. You know, it was not easy.”

The remark is causing a storm of criticism, both for its lack of veracity and for its insensitivity to what actual financial struggle means in a nation with 46 million people living below the poverty level – including almost one in every five children.

. . . Former Presidents are not “dead broke” by any possible interpretation. They receive a pension, which is currently 10 times the poverty level for a family of three; monies for staff, travel, an office, postage and supplies and Secret Service protection for themselves and their spouse.

The President’s pension kicks in as soon as he leaves office. According to the Congressional Research Service, former President Clinton received in pension and other perks, adjusted for 2013 dollars, $335,000 in fiscal year 2001; $1.285 million in 2002, and over $1 million every year thereafter through 2011. Since 2011, the outlay by the taxpayer for former President Clinton has been just under $1 million. Including what is budgeted for fiscal year 2014, Clinton will have received a taxpayer outlay of $15,937,000 since leaving the White House in 2001.

According to the Congressional Research Service, for fiscal year 2014, “office space rental payments were the highest category of cost for former Presidents Clinton and George W. Bush” with former President Clinton’s office budgeted at $450,000 and former President George W. Bush’s budgeted at $440,000. Both former Presidents Clinton and G.W. Bush have offices of over 8000 square feet, more than three times the size of many middle class homes.

A former President’s pension is equal to pay for Cabinet Secretaries, which was $199,700 in calendar year 2013 and set to rise to $201,700 this year.

Both of the Clintons likely knew they would become multi-millionaires very rapidly upon leaving the White House. Just sixteen days after George W. Bush was sworn in on January 20, 2001, Bill Clinton delivered his first speech for $125,000 to Wall Street brokerage and investment bank Morgan Stanley. The speeches continued every few days, with the former President earning an eye-popping $1.475 million in just his first two months out of office. The price per speech has reached $250,000, $300,000 even $500,000 at times. The Clintons earned millions more in book advances and royalties.

According to the joint tax return released by the Clintons, in that 2001 year of financial desperation, the couple reported unadjusted gross income of $15.6 million in business income (mostly from Bill Clinton’s speeches); pension payments of $152,700; dividends of $172,621 and wages of $154,952.

. . . One institution that did not believe the Clintons were “dead broke” was Citigroup. According to PolitiFact, Citigroup provided a $1.995 million mortgage to allow the Clintons to buy their Washington, D.C. residence in 2000. That liability does not pop up on the Clinton disclosure documents until 2011, showing a 30-year mortgage at 5.375 percent ranging in face amount from $1 million to $5 million from CitiMortgage. The disclosure says the mortgage was taken out in 2001.

Citigroup also paid Bill Clinton hundreds of thousands of dollars in speaking fees after he left the White House. It committed $5.5 million to the Clinton Global Initiative — a program which brings global leaders together annually to make action commitments. Citigroup employees have also been major campaign funders to Hillary Clinton.

And, Citigroup is one other thing: it was the major beneficiary of the repeal of the Glass-Steagall Act, the depression era investor protection legislation which for almost seven decades had kept the financial system safe from the Wall Street greed and gambling with led to the 1929 crash.

Just 9 years after its 1999 repeal, Wall Street collapsed in just as spectacular a fashion as in 1929 and the early 30s.

Sandy Weill, the CEO at Citigroup who lobbied for this repeal, was given a commemorative pen from the Clinton signing ceremony which repealed the legislation. Robert Rubin, Clinton’s Treasury Secretary who lobbied for the repeal, was given a non-management post on the Board of Citigroup which paid him over $115 million over the next decade.

The Clintons, who now have a net worth in the range of $100 million, have done very well for themselves with the help of their friends on Wall Street. The country – not so much.

Crushing Occupy Wall Street: It Was All About the Pitchforks

. . . If one were to compile a timeline, it would confirm that the Occupy movement, through much human suffering in outdoor encampments in frigid temperatures, brutal arrests at the hands of a billionaires’ police state, and incessant snark from Fox News, built the foundation for the growing debate about the unprecedented income and wealth inequality in America.

John Kasich’s (Not So) Secret Extremism: How the “Moderate” Alternative to Trump Led a Planned Parenthood Witchhunt in Ohio_ _ _ _ _ _ _

(Friends, sorry not to have published in the last few days, but as usual, my Blogger program blew up and swallowed itself - and wouldn't you know that I had a mind-blowing essay to share (maybe that's why it disappeared?). I've got to switch to WordPress like all my not-so-forgiving blogger buddies.)

Even When Bernie Sanders Wins, He Loses at the New York TimesI'm guessing if Bernie wins big anywhere in next Tuesday's banging vote off, it won't be reported, unless it makes Hillary's percentage look not as small a loss as it's shaping up to be.

Bernie Who? Polls and Big Media Eat Crow This Morning

By Pam Martens and Russ Martens

March 9, 2016

There is a lot of hand-wringing in the Hillary Clinton campaign this morning and a lot of head scratching in corporate media newsrooms over the egregiously flawed polls that predicted a double-digit win for Clinton over Senator Bernie Sanders in the delegate-rich state primary held in Michigan yesterday. With 97 percent of the vote counted this morning, CNN reports that Sanders took 50 percent of the vote to Clinton’s 48 percent. (Clinton easily won Mississippi as polls predicted accurately.)

In a poll taken by Fox2 Detroit/Mitchell between March 3 to March 7, Clinton was said to be leading Sanders by 21.4 points in Michigan. An NBC/Wall Street Journal/Marist poll had Clinton leading by 17 points in a poll taken between March 1 and March 3. CBS/YouGov reported that their poll taken from March 2 to March 4 had Clinton winning by 11 points.

Harry Enten at "FiveThirtyEight" summed up the embarrassment this morning, writing:

“Bernie Sanders made folks like me eat a stack of humble pie on Tuesday night. He won the Michigan primary over Hillary Clinton, 50 percent to 48 percent, when not a single poll taken over the last month had Clinton leading by less than 5 percentage points. In fact, many had her lead at 20 percentage points or higher. Sanders’s win in Michigan was one of the greatest upsets in modern political history.”

What explains the flawed polling? Amanda Girard of "US Uncut" thinks the fact that polling was predominantly done to potential voters on their landline phones, as opposed to mobile phones which are widely used by Sanders’ younger supporters, may have been a factor. (We know plenty of Millennials who don’t even own a land line phone, using their mobile phone for calls, texting, emailing, web browsing and photo sharing.)

We also thought it would be worthwhile to see how corporate media handled the upset win by Sanders on the front pages of their digital editions this morning. Our interest was piqued after Adam Johnson of Fairness and Accuracy in Reporting (FAIR) wrote yesterday that the "Washington Post" ran 16 negative stories on Senator Bernie Sanders in 16 hours, including during the pivotal Democratic debate in Flint, Michigan. Johnson produced the headlines to back up his position. "AlterNet" picked up the story yesterday, generating an astounding 543 comments and hurtling the story across social media web sites. The theme of the typical comment: there is too much corporate control of both media and elections in the U.S.

That Tea Party wunderkind, Donald The Drumpf, is really reeling them in . . . or knocking them out?

Here's The Donald in action in Fayetteville, NC, yesterday . . . and why do the police always seem to be working for The Don?

Are you seriously asking that?

Robert Reich: Donald Trump is a 21st century American fascist

Noam Chomsky: The world should be utterly terrified of a Trump presidency

A vote for The Donald is a vote for torture, global warming and world war, warns celebrated activist-philosopher

_ _ _ _ _ _ _

I believe I've mentioned before that I was left holding worthless WorldCom and a few other fraudulently rated AAA stocks when the bottom dropped out. That was the end of my trust of the Wall Street Mafia.

Regulatory capture?

Ha.

How about total capture?

Theft of Your Money on Wall Street: Another GAO Report Won’t Help

By Pam Martens and Russ Martens

March 7, 2016

It was considered big news last week that House members Maxine Waters of the Financial Services Committee and Al Green of the Subcommittee on Oversight and Investigations have requested that the Government Accountability Office (GAO) launch an investigation of “regulatory capture” on Wall Street.

That news broke on Friday, one day after Senator Elizabeth Warren grilled the head of a Wall Street self-regulatory agency in a Senate hearing on a new study showing that stockbrokers with serial records of misconduct are allowed to remain in the industry. Warren also cited another recent study showing that even when investors prevail in arbitrations against bad brokers, they may never get paid.

According to the study, over $60 million in fines owed to investors have not been paid since 2013.

The individual that Senator Warren was grilling is Richard Ketchum, head of the Financial Industry Regulatory Authority (FINRA), a self-regulatory body financed by Wall Street that oversees brokerage firms and has a division that runs a private justice system known as mandatory arbitration that hears all claims against bad brokers. FINRA was previously known as the National Association of Securities Dealers (NASD) but its reputation became so damaged as a self-regulator that it changed its name to FINRA. (Like that was really going to help.)

What the public doesn’t know is that for over 30 years, the GAO has been investigating these identical problems on Wall Street and making recommendations for cleaning up the mess.

After 30 years, it should be abundantly clear that reading GAO reports and shaking one’s head isn’t getting the job done. Serious, radical reform of Wall Street is necessary and that means eliminating crony regulators and the entire self-regulatory system.

As far back as 1978, the GAO published the results of an investigation into the Securities and Exchange Commission’s oversight of the self-regulatory actions of the NASD. The report found flaws in the NASD’s examinations of brokerage firms and that the SEC had “not dealt aggressively enough with inspection oversight problems.”

Again in 1994, the GAO looked into unscrupulous broker activity on Wall Street. The study found that there was the perception that the SEC and NASD were “lenient” in disciplinary actions and that some brokers that had been barred from keeping a license to make securities transactions were entering other sectors of the financial services industry.

By July 17, 1996, this egregiously flawed system of oversight led to the U.S. Justice Department charging the largest firms on Wall Street with price fixing on the electronic stock market known as Nasdaq, while the self-regulator, the NASD, was aware of the problems but simply ignored them.

The Justice Department findings made it clear that the price fixing had been taking place for more than a decade. (The more recent cartel activity of rigging Libor and rigging foreign currency markets by Wall Street banks is simply an extension of what was transpiring in 1996.)

The outrage was so widespread in 1996 that the trade magazine, "Registered Representative," ran a cover story titled “How the NASD Was Corrupted.” The magazine cover included this assessment:

“The SEC’s investigation of the NASD uncovered a self-regulatory system corrupted by the influence of powerful market making firms. Top NASD officials knew about problems and chose to look the other way. NASD staff went along. Even the SEC had plenty of clues that something was amiss.”

By 2003, Wall Street was reeling from news coverage of how regulators had allowed Wall Street stock research to become corrupted in order for the banks to get investment banking deals.

The PBS program, "Frontline," aired a program on May 8, 2003 titled “The Wall Street Fix.” Correspondent Hedrick Smith tells viewers: “It’s a story of pervasive corruption here on Wall Street, how brokers and analysts shaped and hyped the telecom boom, pocketed enormous profits and then took millions of ordinary investors on a catastrophic ride, $2 trillion in losses on WorldCom and other telecom stocks.”

A year earlier, "Business Week" had asked this simple question on its cover: “Wall Street: How Corrupt Is It?” with a snake curled around the street sign suggesting the answer.

As for the regulators and Congress tolerating investors being victimized twice – first by the unscrupulous broker and then when their arbitration award is not paid – (should the investor be so lucky to have his or her case heard before non-conflicted arbitrators), the GAO has been investigating unpaid awards for almost two decades with nothing to show for it.

In a report titled “"Securities Arbitration: Actions Needed to Address Problem of Unpaid Awards",” the GAO found that 49 percent of the arbitration awards to investors were not paid at all in 1998 and 12 percent were only partially paid. GAO said it “estimated that the amount of unpaid awards was about $129 million, or 80 percent of the $161 million awarded to investors during 1998.”

And here we are, 18 years later, with Senator Warren asking the head of NASD’s successor, FINRA, what he plans to do about $60 million in unpaid awards to investors dating back to 2013.

FINRA also likes to brag about how much it has done to help investors by setting up BrokerCheck, where investors can check to see if their stockbroker has a disciplinary history. But the problems here are myriad. We put in a broker’s name whom we know was licensed and employed at Smith Barney as a retail broker over a long period. The broker doesn’t even exist in the database. Nor does he exist in the Investment Advisor lookup. He just doesn’t exist.

Brokers with five, six and even seven arbitration claims against them are still employed at the same firm. But you wouldn’t know that from the BrokerCheck system which shows serial employer name changes when it is actually the same firm. So the uninitiated at the GAO or SEC might assume that the broker is being fired for misconduct and moving to a new firm when he is actually sitting in the same seat for three decades without any serious disciplinary measures being taken because he is producing large commissions for his firm.

Another problem is that FINRA’s arbitrators allow Wall Street firms to agree to settle arbitrations and have the matter expunged from the broker’s record. Reuters reported in 2013 that “Brokers succeeded 96.9 percent of the time between mid-2009 and the end of 2011 in expunging details about cases brought by investors against their firms that were later settled, according to the Public Investors Arbitration Bar Association, a trade group for lawyers representing investors.”

In one instance, according to the "Reuters" article, one broker “requested expungement 40 times – and was granted relief by arbitration panels for 35 of the requests.”

Congress has known for decades that self-regulation doesn’t work.

And installing Wall Street’s former lawyers or Wall Street executives at the SEC doesn’t work either. Tolerating the systemic conflicts of interest at the New York Fed, the sole regulator of Wall Street bank holding companies, has been catastrophic to the U.S. economy. Congress fully understands what’s causing regulatory capture; it just doesn’t have the guts to do anything about it but kick the can down the road to the GAO.

As far as electing another U.S. President whose campaign has been financed by Wall Street and expecting a different outcome, let’s hope and pray most Americans are smarter than that.

Daniel Ellsberg: Nixon Ordered Break-In at Ellsberg's Psychoanalyst to Silence Whistleblower_ _ _ _ _ _ _

A Warning From the B.I.S.: the Calm Before the Storm?

by Mike Whitney

March 10, 2016

The Bank for International Settlements (BIS) is worried that recent ructions in the equities markets could be a sign that another financial crisis is brewing. In a sobering report titled “Uneasy calm gives way to turbulence” the BIS states grimly: “We may not be seeing isolated bolts from the blue but the signs of a gathering storm that has been building for a long time.”

The authors of the report are particularly concerned that the plunge in stock prices and the slowdown in global growth are taking place at the same time that investor confidence in central banks is waning. The Bank Of Japan’s (BOJ) announcement that it planned to introduce negative interest rates (aka–NIRP or negative interest rate policy) in late January illustrates this point.

The BOJ hoped that by surprising the market, the policy would have greater impact on borrowing thus generating more growth. But, instead, the announcement set off a “second phase of turbulence” in stock and currency markets as nervous investors sold off risk assets and moved into safe haven bonds. The BOJ’s action was seen by many as act of desperation by a policymaker that is rapidly losing control of the system. According to the BIS:

“Underlying some of the turbulence of the past few months was a growing perception in financial markets that central banks might be running out of effective policy options.”This is a recurrent theme in the BIS report, the notion that global CBs have already used their most powerful weapons and are currently trying to muddle-by with untested, experimental policies like negative rates that slash bank profitability while having little impact on lending.

While the BIS report provides a good rundown of recent events in the financial markets, it fails to blame central banks for any of the problems for which they alone are responsible. The sluggish performance of the global economy, the massive debt overhang, and the erratic behavior of the stock market are all directly attributable to the cheap money policies coordinated and implemented by central banks following the Great Recession in 2008. It’s hard to believe that the BIS’s failure to insert this fact into its narrative was purely accidental.

But the real problem with the BIS report is not that it refuses to assign blame for the current condition of the markets and the economy, but that it deliberately misleads its readers about the facts. While it’s true that China is facing slower growth, oil prices are plunging, emerging markets have been battered by capital flight, and yields on junk bonds are relentlessly rising, it’s also true that central bank policy is not primarily designed to address these problems, but to ensure the continued profitability of its main constituents, the big banks and mega-corporations. Keep in mind, the global economy has been sputtering for the last 6 years, but the BIS has only expressed alarm just recently. Why? What’s changed?

What’s changed is profits are down, and when profits are down, Wall Street and its corporate allies lean on the central banks to work the levers to improve conditions. Here’s more on the so called “earnings recession” from an article in the "Wall Street Journal" titled “S&P 500 Earnings: Far Worse Than Advertised”:

“There’s a big difference between companies’ advertised performance in 2015 and how they actually did.How big? ….S&P earnings per share fell by 12.7%, according to S&P Dow Jones Indices. That is the sharpest decline since the financial crisis year of 2008. Plus, the reported earnings were 25% lower than the pro forma figures—the widest difference since 2008 when companies took a record amount of charges.The implication: Even after a brutal start to 2016, stocks may still be more expensive than they seem. Even worse, investors may be paying for earnings and growth that aren’t anywhere near what they think. The result could be that share prices have even further to fall before they entice true value investors.” ( “S&P 500 Earnings: Far Worse Than Advertised“, Wall Street Journal)Profits are down and stocks are in trouble. Is it any wonder why the BIS is running around with its hair on fire?

Also, corporate earnings have dropped for two straight quarters which is a sign that the economy is headed for a slump. Take a look at this clip from CNBC:

“Recessions have followed consecutive quarters of earnings declines 81 percent of the time, according to an analysis from JPMorgan Chase strategists, who said they combed through 115 years of records for their findings.”(CNBC)“81 percent” chance of a recession?

Yep.

This is what the BIS is worried about. They could are less about China or the instability they’ve created with their zero rates and cheap money policies. Those things simply don’t factor into their decision-making. It’s all just fluff for the sheeple. Here’s more from Jim Quinn at "Burning Platform:"

“The increasing desperation of corporate CEOs is clear, as accounting gimmicks and attempts to manipulate earnings in 2015 has resulted in the 2nd largest discrepancy between reported results and GAAP results in history, only surpassed in 2008…..Based on fake reported earnings per share, the profits of the S&P 500 mega-corporations were essentially flat between 2014 and 2015…..earnings per share plunged by 12.7%, the largest decline since the memorable year of 2008….With approximately $270 billion of “one time” add-backs to income used to deceive the public, the true valuation of the median S&P 500 stock is now the highest in history – higher than 1929, 2000, and 2007. Wall Street’s latest con game, with the active participation of corporate CEO co-conspirators, is a last ditch effort to fend off the inevitable stock market crash….All economic indicators are flashing red for recession. Stocks are poised for a 40% decline faster than you can say Wall Street criminal banks.” (“The Great Corporate Earnings Fraud“, "Burning Platform")

Get it? When the profitability of the world’s biggest corporations are at stake, the central banks will move heaven and earth to lend a hand. This was the basic subtext of the discussions at the recent G-20 summit in Shanghai, China. The finance ministers and central bankers wracked their brains for two days to see if they could settle on new strategies for boosting earnings. In fact, the austerity-minded IMF even called on the G-20 to support a coordinated plan for fiscal stimulus to boost activity and decrease the risks to the equities markets.

Unfortunately, finance ministers balked because fiscal stimulus puts upward pressure on wages and shifts more wealth to working stiffs. That’s why the idea was shelved, because the oligarchs can’t stand the idea that workers are getting a leg-up. What they want is a workforce that scrapes by on minimum wage and lives in constant fear of losing their job. The class war continues to be a top priority among the nations voracious CEOs and corporate bigwigs.

The “failed” G-20 summit was clearly a turning point for the markets. Now that the central banks are out of ammo, the only hope to keep stock prices artificially high rested on Keynesian fiscal stimulus injected directly into the real economy. That hope was extinguished at the meetings. The prospect that equities can continue to climb higher in the face of shrinking profits, tighter credit, slower growth and bigger corporate debtloads is unrealistic to say the least. Just check out this excerpt from a recent article at Bloomberg:

“Companies still have a little time before they must pay down the bulk of $9.5 trillion of debt maturing in the next five years….But it’s not getting any easier for these corporations to borrow, at least not in the U.S. In fact, many of these obligations are becoming harder and more expensive to repay at a time when companies face a historic pile of bonds and loans coming due.It’s not terribly surprising that companies have a bigger debt load to pay down. They borrowed trillions of dollars on the heels of unprecedented stimulus efforts started by the Federal Reserve at the end of 2008 during the worst financial crisis since the Depression. They kept piling on the leverage as central banks around the world doubled down on low-rate policies and kept purchasing assets to encourage investors to buy riskier securities….What the author is saying is that central bank policy seduced corporations into borrowing tons of money that they frittered-away on stock buybacks and dividends, neither of which create the revenue streams necessary to repay their debts. So rather than build their companies for the future, (Business investment is at record lows) corporations have been behaving the same way the Wall Street banks acted before the Crash of ’08. They’ve been borrowing trillions from Mom and Pop investors via the bond market, goosing their share prices through stock buybacks, increasing executive compensation, and dumping the money in offshore accounts. Now the bill is coming due, and they don’t have the money to repay the debt or the earnings-potential to avoid default. Something’s gotta give.

Corporate red ink is one of many reasons why the BIS thinks “We may not be seeing isolated bolts from the blue but the signs of a gathering storm that has been building for a long time.” Like the gigantic asset-price bubble in stocks, it’s a sign that the economy and the markets are headed for a long and painful period of adjustment.

2 comments:

Not just Hillary and her husband are liars and crooks but 99% of congress, the senate and our president are on the take. You said the unsophisticated are for Trump. Well we could use some unsophisticated honest people in Washington DC. All the people in congress, the senate and that includes our president went to Harvard and other so called good schools, are liars and being paid by wall street and corporations and the pharmaceutical companies. The main reason for Trumps popularity is the fact that we can't trust anyone up there including Obama. Trump will do more good for the people in this country than any president since FDR.

It's a carnival of liars.

The nazi liars, however, will kill you quicker.

Or maybe not

I don't want to rile up the masses (other than to get them to register and vote for Bernie in self defense), but I can't help thinking at times like this about who has been in charge of our education system.

Those Harvard and Yale types seem not have been helped by their superior educations - although having as little true education as Trump, Christie, Carson, Bush, etc., is no resume lifter either. Those without any education do sometimes seem to have a certain common sense that is desirable, but then so many of them go off the deep end over an authority figure like Trump, which completely disqualifies their previously touted common sense.

But I do go on.

Thanks for responding.

Post a Comment